TSE notification obligation – Changing data

If you have already submitted your reportable data and there are changes to your company data, you must also report these to the tax authorities.

The same applies here as for the initial report:

- If you only use one electronic recording system at your place of business, you can automatically submit the information directly in your administration interface.

- If you use multiple electronic recording systems at your place of business, you must report them manually in the ELSTER portal.

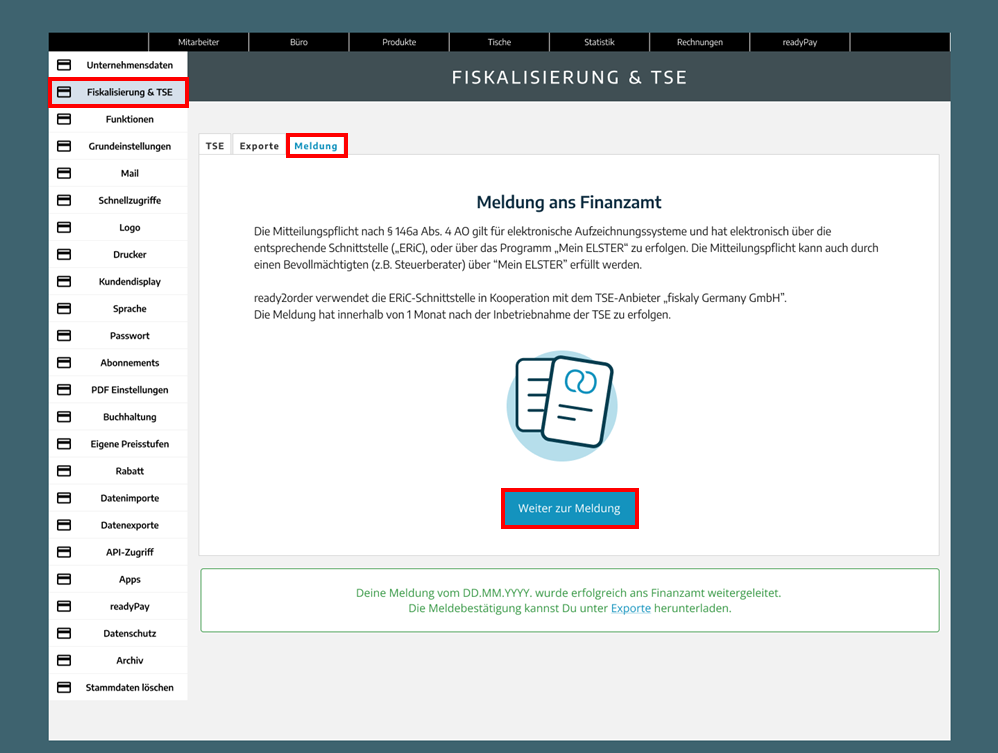

Automatic submission of data changes

You can automatically submit data changes if you only use one record keeping system.

To do this, go to Preferences > Fiscalization & TSE > Submission in your Admin Interface.

Now follow the steps for automatic notification. You can find these instructions here.

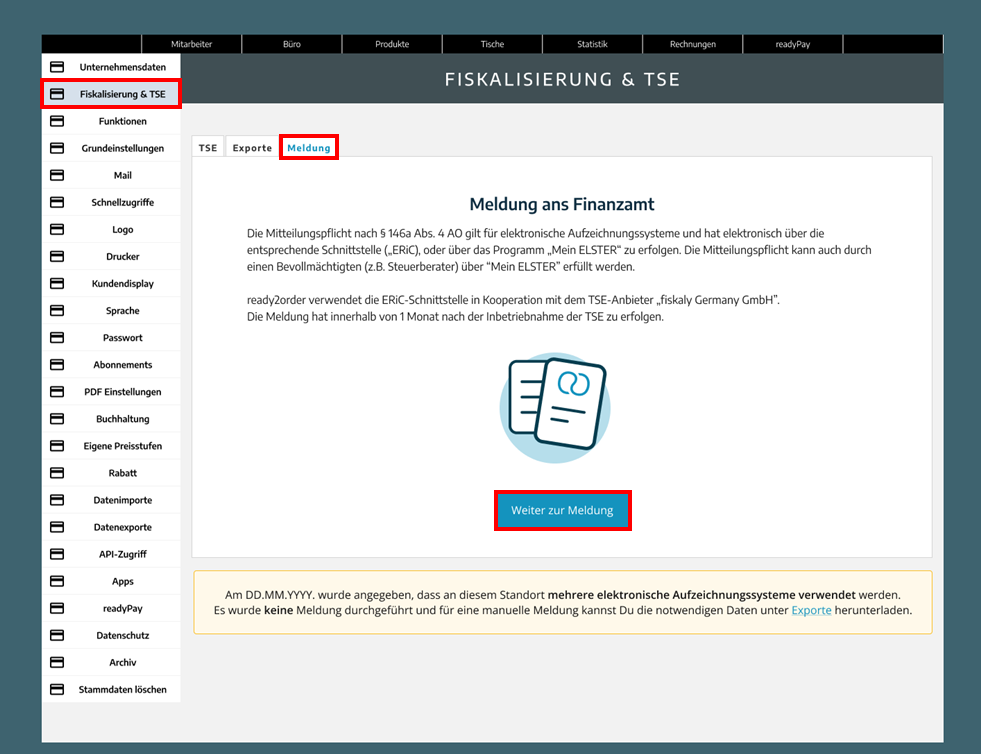

Manual reporting of data changes

If you use multiple electronic record keeping systems, you must report them manually in the ELSTER portal. You can change the data accordingly in your administration interface and use the PDF document created with it to carry out the manual report in the ELSTER portal.

There are three ways to get the data necessary for your report to the tax office.

- Go to Preferences > Fiscalization & TSE > Exports in your Admin Interface and download the file Data for the manual submission to the tax office.

- Alternatively, go to Preferences > Fiscalization & TSE > Submission in your Admin Interface and follow through the steps. You will then receive a PDF with the data.

- You can also follow the steps in the instruction guide for reporting electronic recording systems (German) and directly search for the data in your DSFinV-K export. You can find this export under Preferences > Fiscalization & TSE > Exports in your Admin Interface.

Now use the data from the PDF (provided in 1. or 2.) to carry out the submission in the ELSTER portal. A detailed description for this can be found in the instruction guide for reporting electronic recording systems (German) provided by the Federal Ministry of Finance:

FAQ-Instruction-guide.pdf (German)

You can find further information on the manual submission here.