TSE notification obligation – Automatic submission

The submission feature for electronic recording systems will be available from January 1, 2025. This means that if you use a recording system after this date, you must report it.

If you are already operating your recording system(s) before July 1, 2025, you have until July 31, 2025 to report. Electronic recording systems purchased after July 1, 2025 must be reported within one month of purchase.

In this article, you will learn in which cases you can make an automatic submission and what you need to bear in mind. Please read all the information carefully to avoid problems with your tax office.

If you only use one electronic recording system (e.g. ready2order) at your place of business, you can automatically submit your recording system (commissioning) directly in your ready2order Admin Interface. You can also submit data changes directly in the ready2order Admin Interface if you only manage one recording system.

However, in the following cases, you must register/deregister manually in the ELSTER portal:

- You have one recording system at your place of business and would like to deregister it.

- You use multiple recording systems at your place of business and want to report or deregister the systems.

- You use multiple recording systems at your place of business and want to make a data change.

You can find all the information about manual registration/deregistration here.

Perform an automatic submission

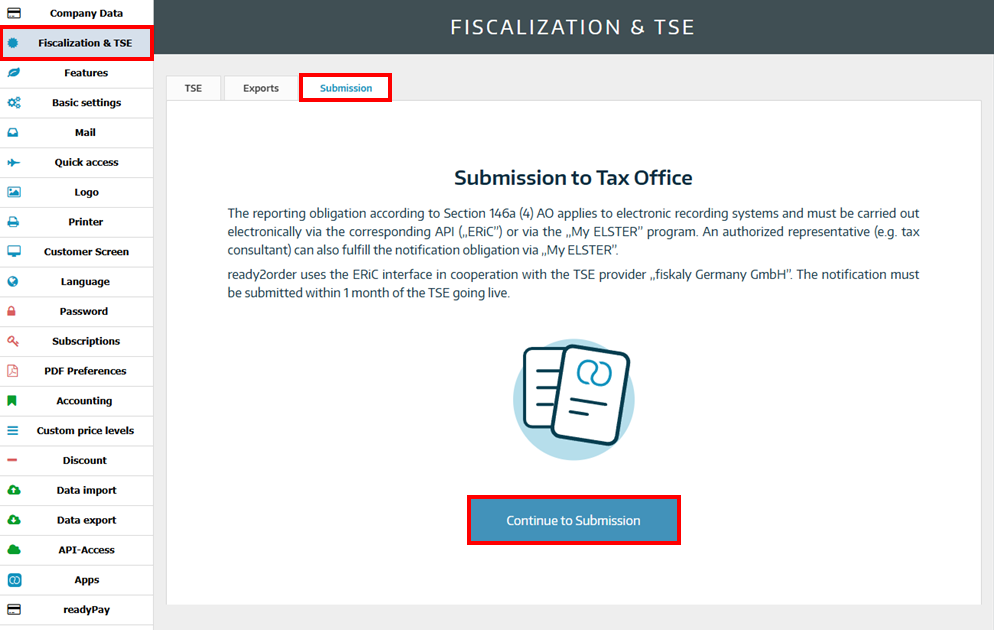

First, go to your Admin Interface and then to Preferences, then to Fiscalization & TSE, and then select the Submission tab. Read the information there and click on Continue to Submission.

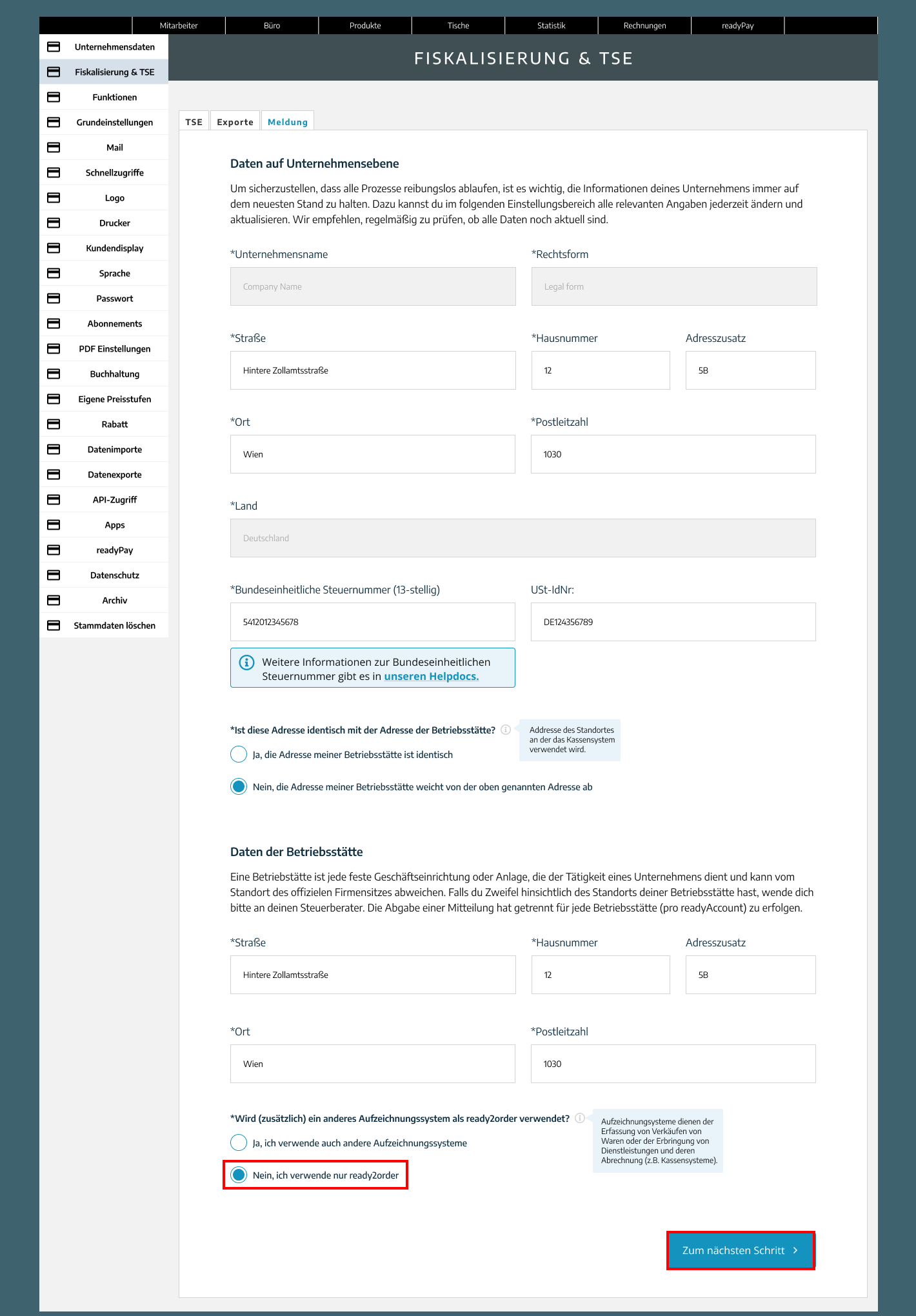

Now check all the data displayed for accuracy and fill in the empty fields with the correct data. If the address at company level is not identical to that of the permanent establishment, choose the appropriate selection and fill in the empty fields there with the correct data.

When you are using one recording system, select No, I only use ready2order. Then select Go to the next step.

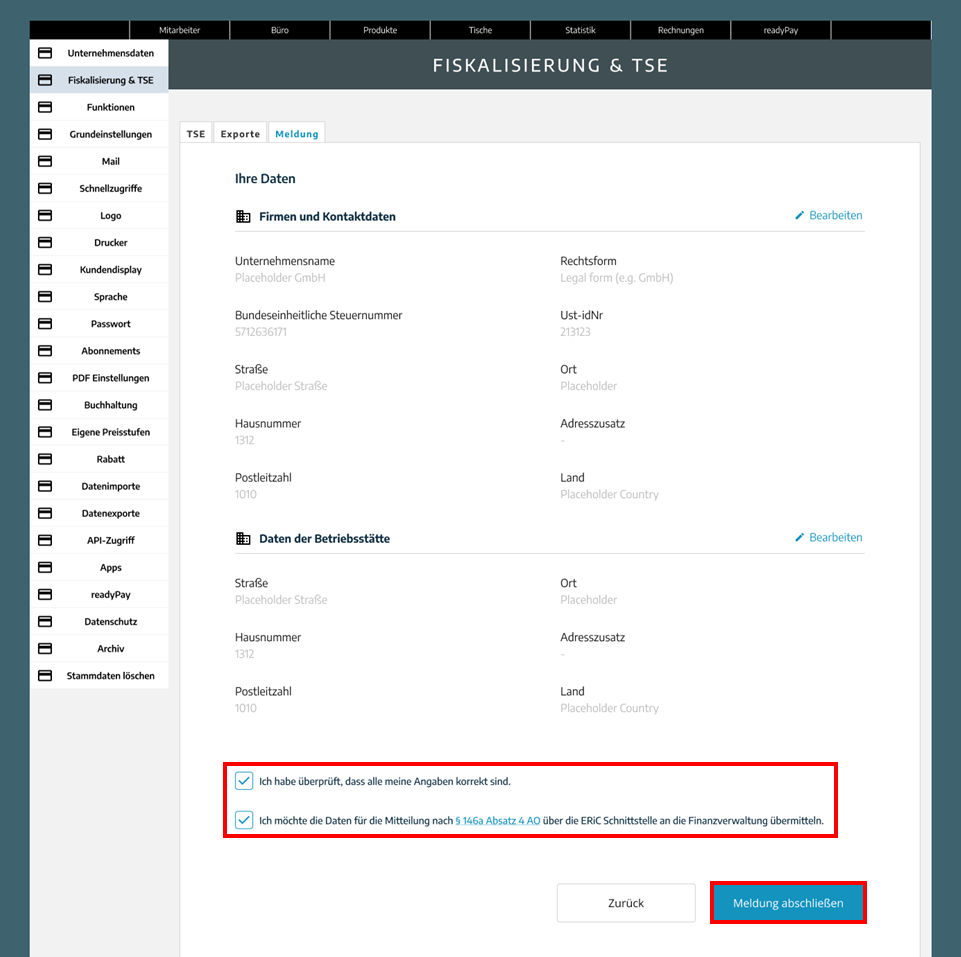

You will now be taken to a page where you must check your entered data again. Make sure that all entered data is correct, and then select the two checkboxes

- I have verified that all my information is correct

- I would like to transmit the data for the notification according to Section 146a Paragraph 4 AO to the tax authorities via the ERiC interface.

and lastly, click Complete Submission.

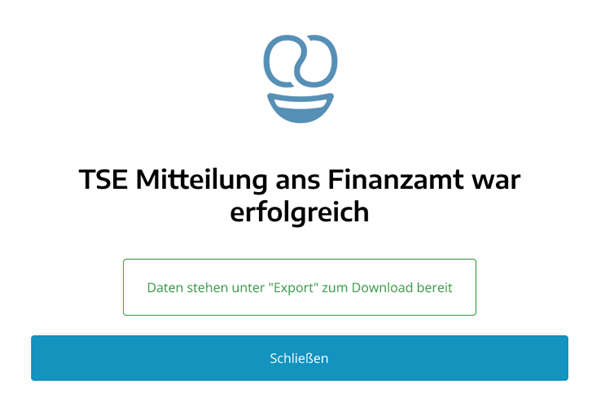

If the transfer was successful, you will now see this window:

Your report to the tax office has now been processed. We recommend that you download the data.