How do I set up my accounting

Here you can find out how to set up accounts according to your needs. You can set up accounts for tax rates, product groups, products, payment methods and cash book categories. If you want to set up accounts, click here for instructions.

If you want to create new accounts, click here for instructions.

If you would like to set up the technical helper-account, click here for instructions.

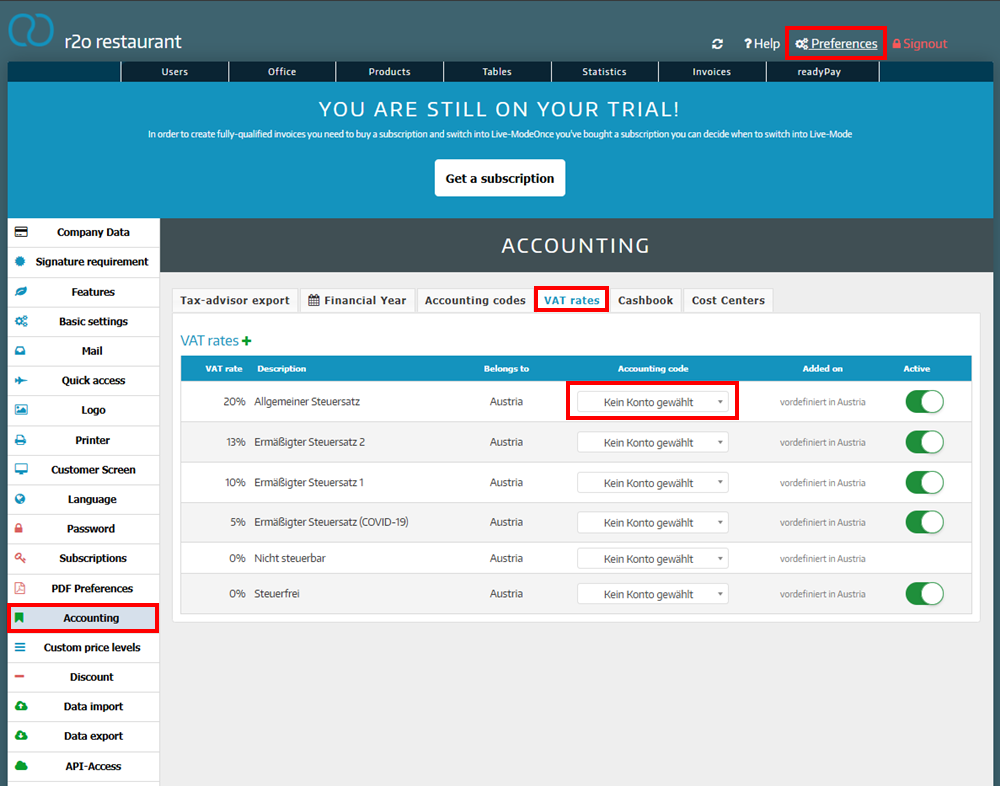

Store accounting codes at VAT rates

These accounting codes apply to all products that have the respective VAT rate stored. The accounting codes are inherited via the VAT rates, so to speak. They can be stored in the Admin Interface via Preferences > Accounting > VAT rates.

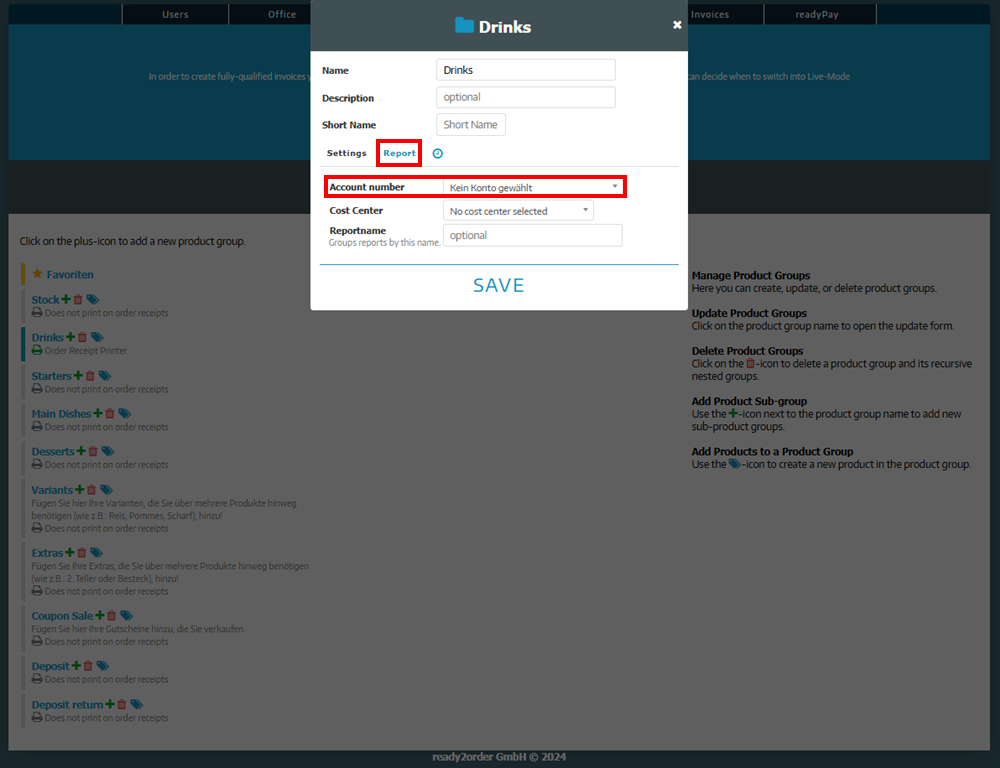

Store accounting codes at product groups

The accounting code that is stored for the product group applies to all products in this group. The accounting code stored here takes precedence over the accounting code stored for the tax rates. Products that already have a specific accounting code stored are not affected by this. This can be stored in the Admin Interface via Products > Product groups. Click on the desired product group and then on the Report tab. You can now select an accounting code.

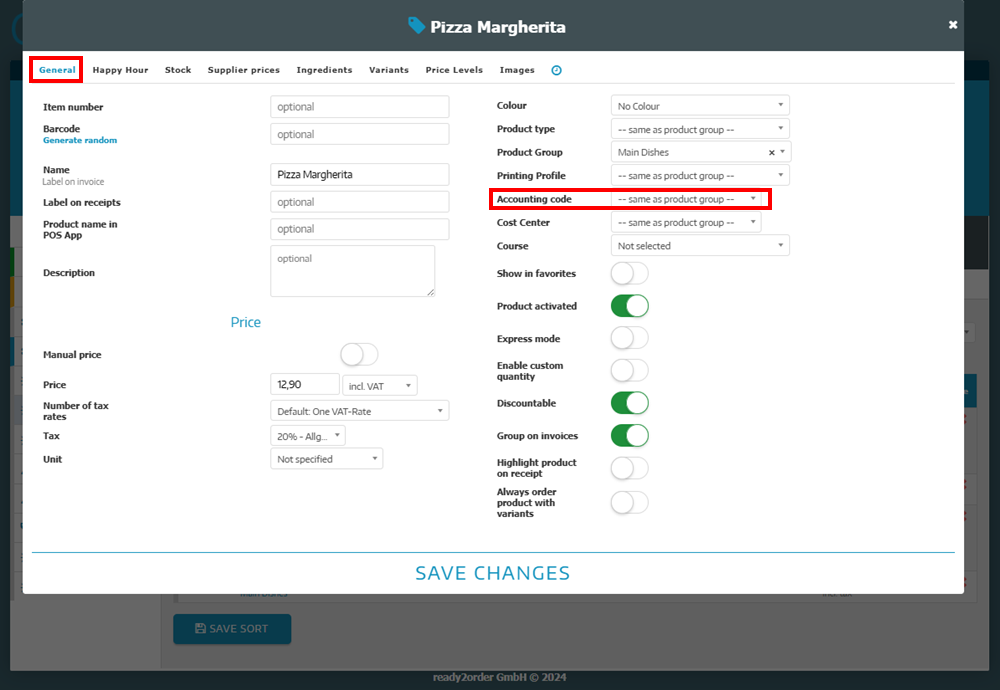

Store accounting codes for products

Accounting codes that are stored directly with a product are given priority over all other settings (product groups, tax rates). To do this, click on Products in the Admin Interface. Click on the yellow pencil next to the desired product. You can store an accounting code in the General tab.

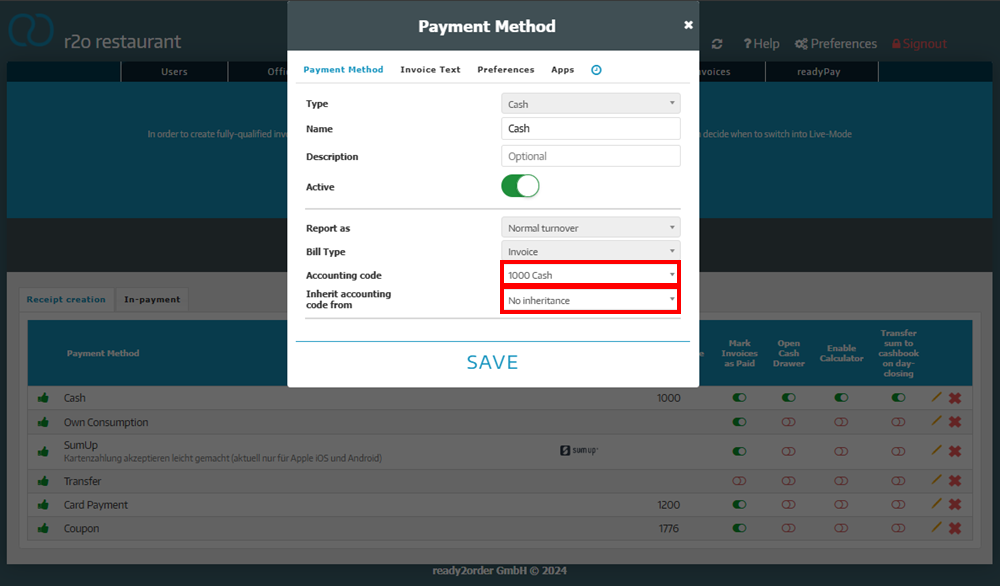

Store accounting codes for payment methods

- In this field you can enter one of the accounting codes you have already created.

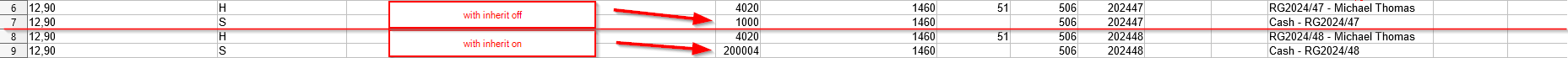

- In the "Inherit Accounting code from" field, you have the option of setting that the customer account is inherited, for example for open invoices. The customer account is then stored as an account in the debit posting. If no accounting code is stored for a payment method, the Accounting code field in the export is automatically filled with account 2000.

Example export cash payment:

Store accounting codes in cashbook categories

To add accounts to cash book categories, you can proceed as described in this article.