Make a new entry in the cashbook

For each new entry, a distinction is made between income and expenditure right at the start. Open the relevant option for a new entry.

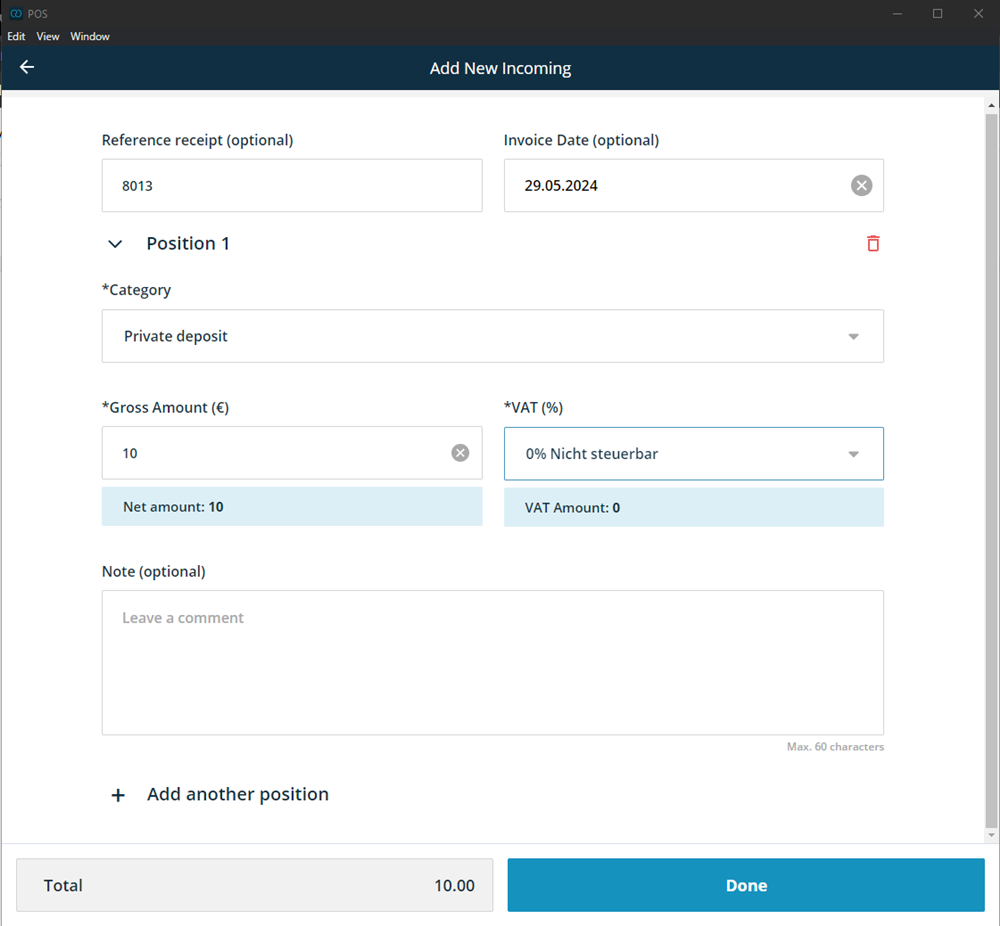

To assign the entry to a document, enter the document number and invoice date in the top line.

• You can enter multiple items in different categories and tax rates in one entry.

• The fields Category, Gross Amount and VAT must be specified for each entry.

• You can add any note to each position.

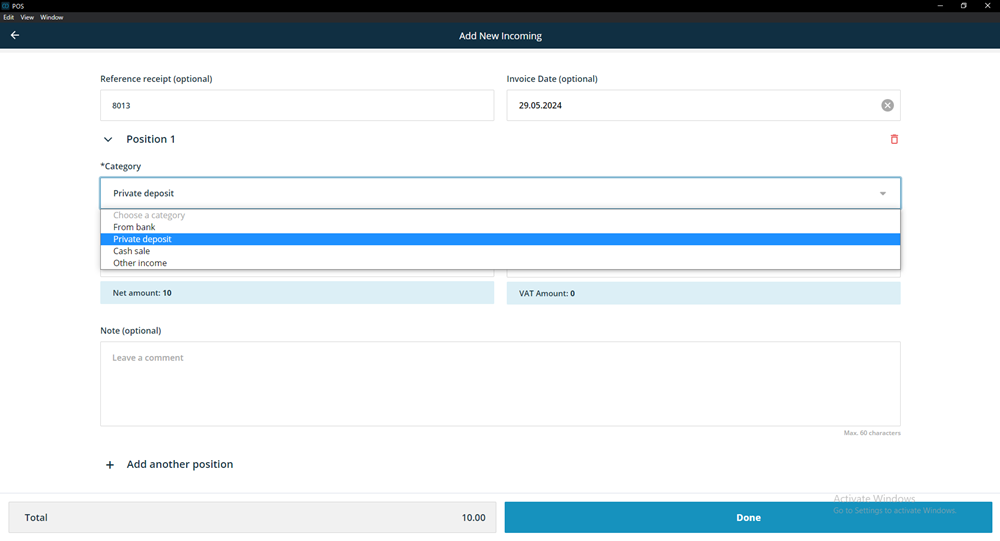

When it comes to income and outgoing, this interface only differs in the categories.

New incoming

For each new income you can select the categories:

• From Bank

• Private deposit

• Cash sale

• Other input

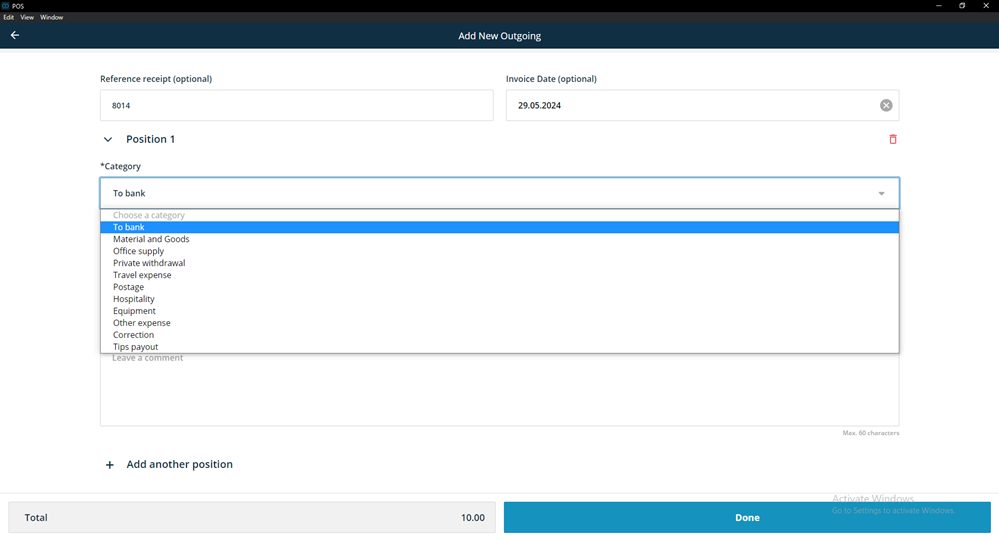

New outgoing

For withdrawals or expenses from the cashbook, you can select these categories:

• To Bank

• Purchasing of materials and goods

• Office supplies

• Private withdrawal

• Travel expenses

• Postage

• Entertainment costs

• Small appliance

• Other output

• Correction

• Tip payout