How do I activate differential taxation and what do I need to take into account?

The margin scheme is a special regulation that is mainly used when trading in used goods, works of art, antiques, or collectibles. This guide explains how to activate the margin scheme in ready2order and how to use it correctly.

What is the margin scheme?

The margin scheme allows retailers to tax only the difference between the purchase and sales price of a product. This is useful for retailers who purchase goods for which sales tax has already been paid (e.g. in the case of private sales). The regulation ensures that sales tax is not charged twice on the entire sales price.

Prerequisites: Products and Tax

With the margin scheme, no VAT should be shown on the invoices. Therefore, products subject to the margin scheme must use the VAT rate 0% (non-taxable). Ensure all products subject to the margin scheme are entered in your system as "0% non-taxable".

How do you activate the margin scheme in our system?

To apply the needed text of the margin scheme feature correctly in our system, follow these steps:

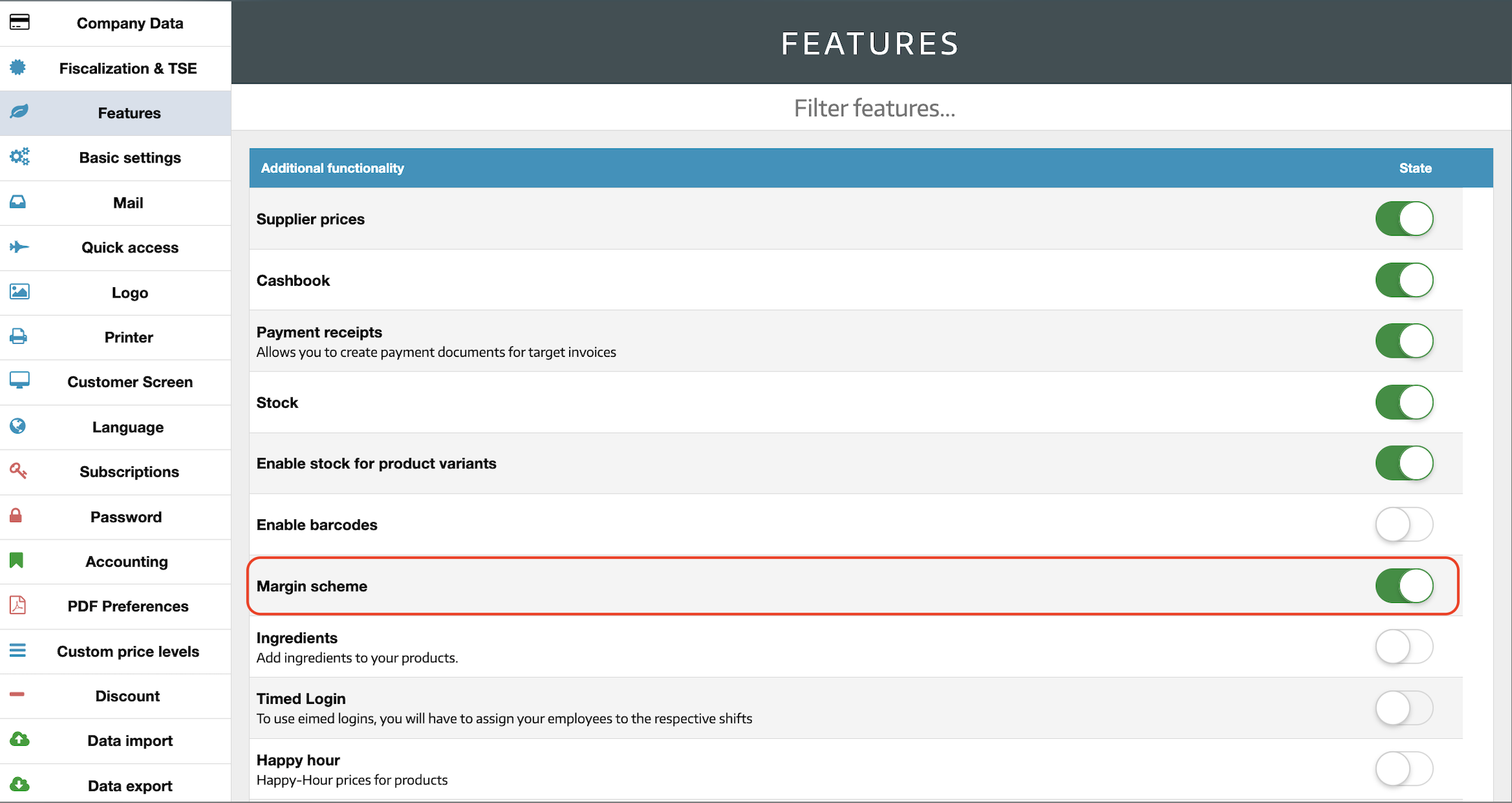

- Go to settings > features.

- Activate the toggle "Margin scheme".

- Now the corresponding paragraph will be always added to new invoices.

Alternatively

- Go to Basic Settings > Invoice > Invoice Text and insert the necessary sentence as invoice text to include it on the receipts.

- The same should be done for PDF invoices under settings > PDF settings > Default texts > Invoice.