Paying out tips – cashbook

You can either have the tip payment done automatically by the system or do it manually.

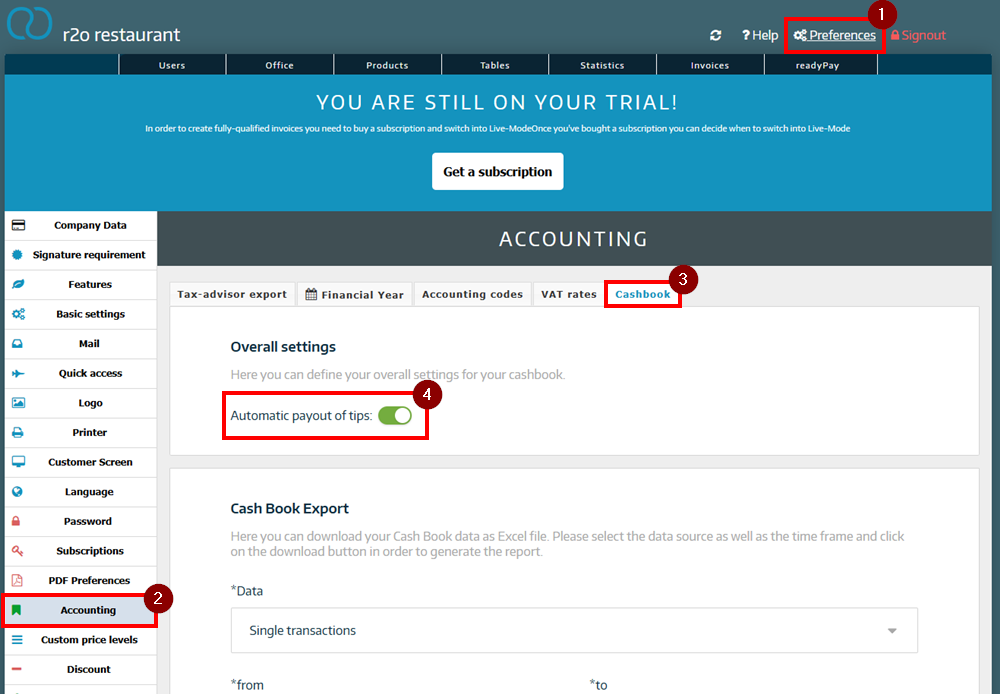

It’s that easy to activate or deactivate automatic tip payout:

- In the administration interface, go to Preferences

- Go to Accounting

- Click on the Cashbook tab

- Here you can activate or deactivate the automatic payout of tips

Here are three example scenarios regarding the admissibility of automatic tip payments*:

- “Tax-free” scenario: You are employed as a waitress in a bar and receive regular tips and small gifts on special occasions such as Christmas from regular customers. This form of tip is referred to as voluntary tipping if no general tipping recommendation (service charge) is given by the restaurant and is therefore tax-free. Automatic tip payment is permitted.

- “Piggy bank” scenario: You work in a beauty salon. The company has a tip piggy bank at the cash register, into which customers put the tips for all employees. The money collected is regularly divided equally among all employees. From the tax office's point of view, there is no direct, personal connection here and the tips are therefore taxable. Automatic tip payments are not permitted.

- “Self-employed” scenario: You are self-employed and own a food truck that you run alone. You regularly receive good tips from your customers for your innovative creations. As a sole proprietor, you must record the money you receive as profit-increasing operating income and pay sales tax on it. Automatic tip payments are not permitted.

Information on automatic tip payout

If you have activated automatic tip payout, the tips received during the day are automatically recorded as outgoings. All tips from all payment methods (for this day or the current Z-receipt) are automatically paid out from the cash register.

However, it can happen that more tips are paid out than there is cash in the till. This could happen if a lot of tips were collected from non-cash payments and these were paid out in cash from the till.

Since the balance in your cash register can never be negative, the tip cannot be paid out automatically.

If the cash balance becomes negative during the automatic daily closing due to the payment of tips, the following steps are carried out:

- Daily closing is carried out

- Tips are NOT paid automatically

- You will receive an email with all information and amounts for the tip payout

- You have to increase the cash balance and pay out tips manually

*Disclaimer: Our articles only represent non-binding information without guarantee of completeness, accuracy and topicality. They do not constitute legal or tax advice and in no way claim to represent or replace such advice.