Specify the initial balance, start number and document group in the new cashbook

To use a new cashbook, you must activate and set up the cashbook in real time.

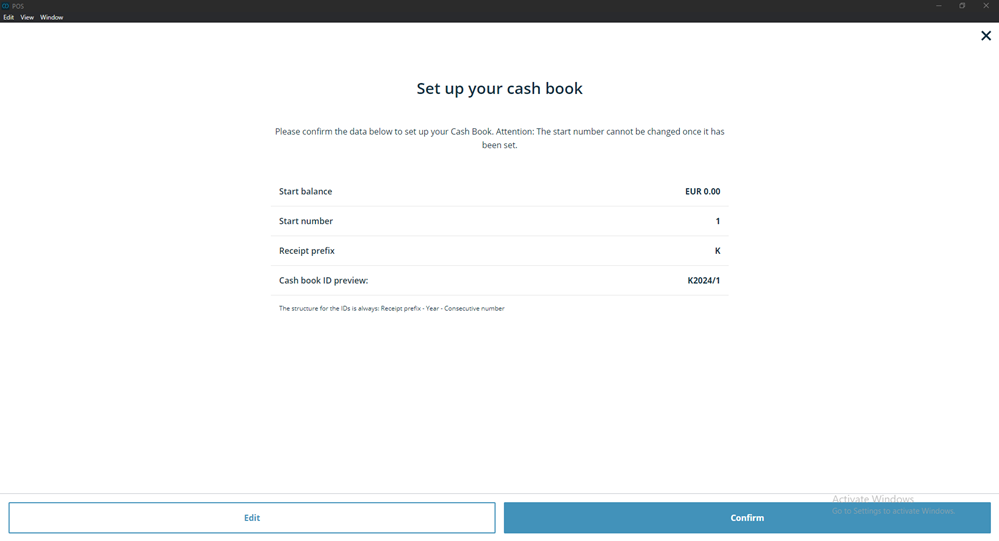

Here you can add an initial balance and specify the starting number and document group.

- Start balance: This is the cash that is in your cash register at the start of the cashbook. If you are switching from another cashbook, the opening balance corresponds to the previous day's closing balance in the other cashbook.

- Start number: All cashbook entries are numbered consecutively. You can use the start number to specify where the numbering begins. If you switch from another cashbook, the start number is linked to the last cashbook number of the other cashbook.

- Receipt prefix: This is the abbreviation that precedes the cashbook number. Usually a letter is used for this, e.g. K or KA for cashbook. If you are switching from another cashbook, you can use the same abbreviation as before.

This information is intended to ensure that the cashbook is kept up to date. It is therefore important to continue the numbering of an old cashbook, if you have one.

Only after the cashbook has been successfully set up will the entries from the cash register be transferred to the cashbook.

To set up the cashbook, the logged in user must have the corresponding user right ("Allow new entries in the cashbook").

If the cashbook is grayed out on the home screen, check the user rights in the administration interface.

If the cashbook is grayed out on the home screen, check the user rights in the administration interface.

During the cashbook activation process, you will see a screen for setting up the cashbook. Change the details accordingly and click "Confirm".

Note that the current day will be closed and a new day will be opened.

Are you currently using the free version of the cash book? You can subscribe to the full version here ›

Did you know that our AI assistant readyBot can also answer your support requests via chat? Click here to access the chat.