TSE notification obligation – Manual submission

The submission feature for electronic recording systems will be available from January 1, 2025. This means that if you use a recording system after this date, you must report it.

If you are already operating your recording system(s) before July 1, 2025, you have until July 31, 2025 to submit the data. Electronic recording systems purchased after July 1, 2025 must be reported within one month of purchase.

In this article, you will learn in which cases you have to register/deregister manually and what you need to bear in mind when doing so. Please read all information carefully to avoid problems with your tax office.

The manual submission of your data is carried out through the ELSTER portal. A detailed description for this can be found in the instruction guide for reporting electronic recording systems (German) provided by the Federal Ministry of Finance:

FAQ-Instruction-guide.pdf (German)

In which cases do I have to register/deregister manually through the ELSTER portal?

If you only have one electronic recording system at your place of business, you can submit your recording system data (commissioning) directly in your ready2order Admin Interface.

However, in the following cases, you must register/deregister manually in the ELSTER portal:

- You have one recording system at your place of business and would like to deregister it.

- You use several recording systems in your place of business and would like to report or deregister the systems.

- You use several recording systems in your facility and would like to make a data change.

The responsibility for entering the reportable data correctly and on time in the ELSTER portal lies solely with the taxpayer. We accept no liability for any errors or omissions when reporting, deregistering or changing data from electronic recording systems. If you need further support, you can read the FAQs of the Federal Ministry of Finance or contact your tax advisor or tax office.

How do I get the data for a manual submission?

There are three ways you can get the necessary data for a manual submission:

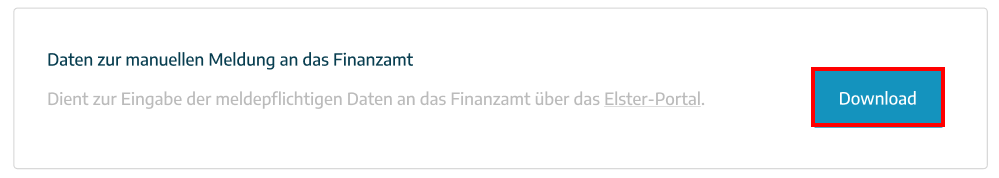

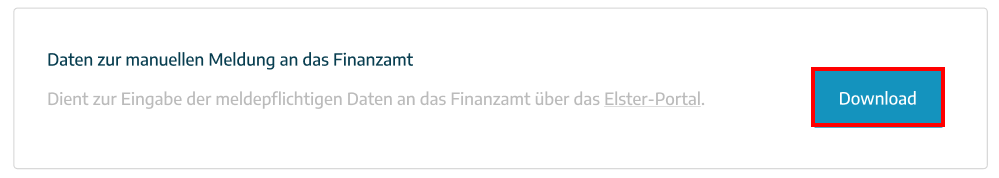

1. Download the PDF under Fiscalization & TSE > Exports

In your Admin Interface, you can download the data anytime under Settings > Fiscalization & TSE > Exports under Data for the manual submission to the tax office.

Now use the data from the PDF to carry out the submission in the ELSTER portal. A detailed description for this can be found in the instruction guide for reporting electronic recording systems (German) provided by the Federal Ministry of Finance:

FAQ-Instruction-guide.pdf (German)

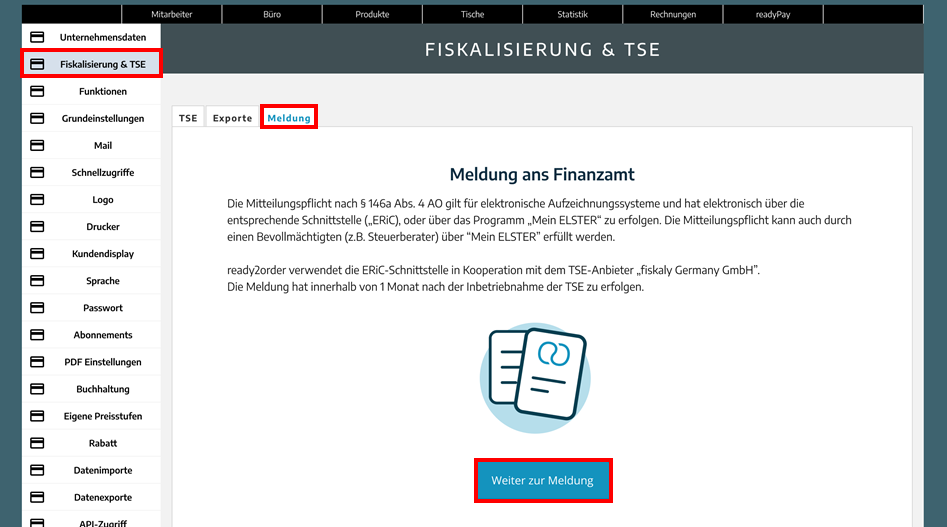

2. Enter the data in the administration under Fiscalization &TSE > Submission and download the PDF

First, go to your Admin Interface and then to Settings, then to Fiscalization & TSE, and then select the Submission tab. Read the information there and click on Continue to the Submission.

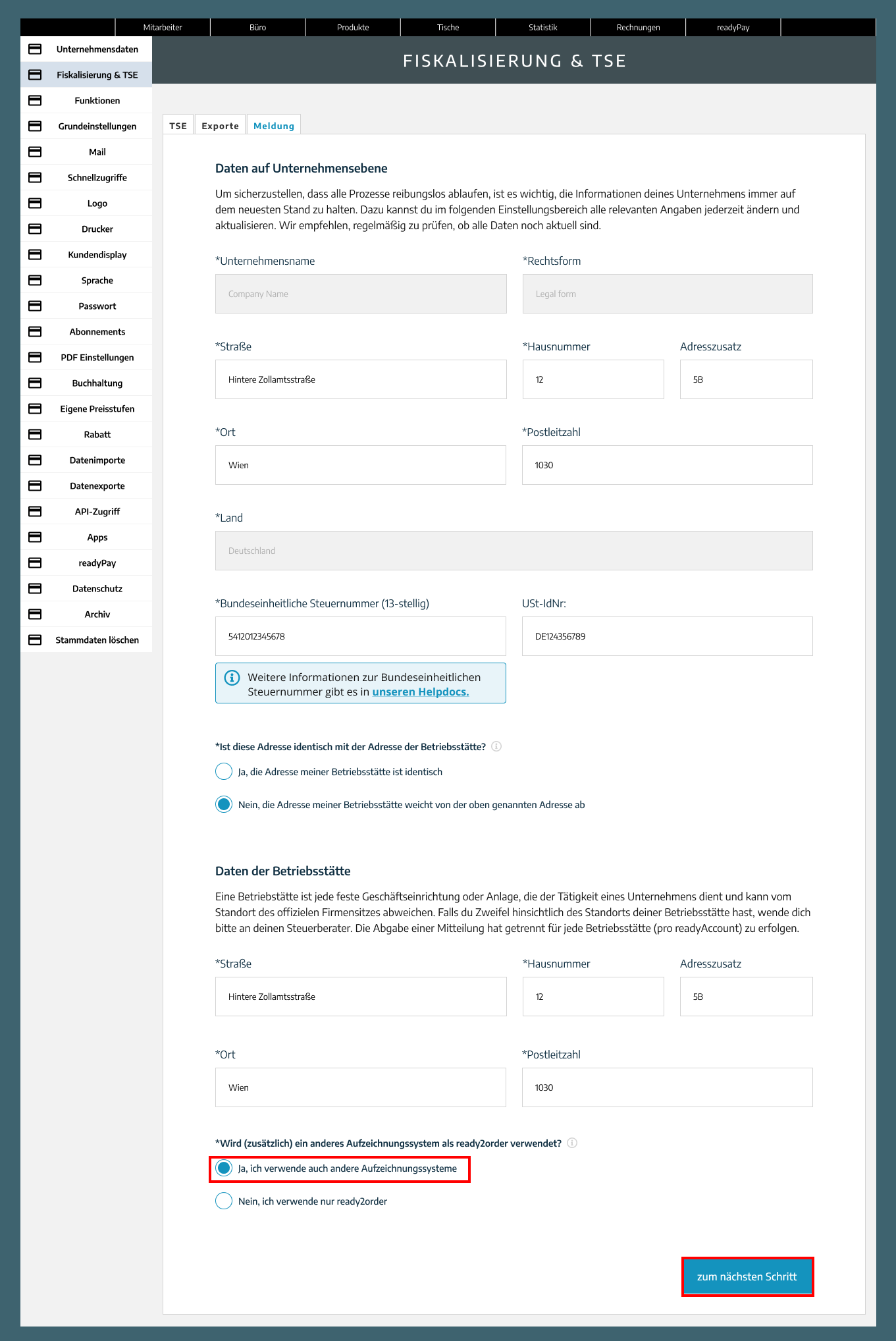

Now check all the data displayed for accuracy and fill in the empty fields with the correct data. If the address at company level is not identical to that of the establishment/place of business, select this accordingly and fill in the empty fields there with the correct data.

Since you use multiple record-keeping systems at your place of business, select: Yes, I also use other record-keeping systems. Then click Next to proceed to the next step.

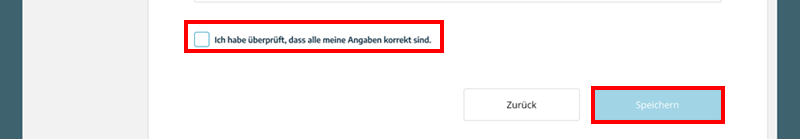

Now check all data again for accuracy, select the box that your information is correct and click Save.

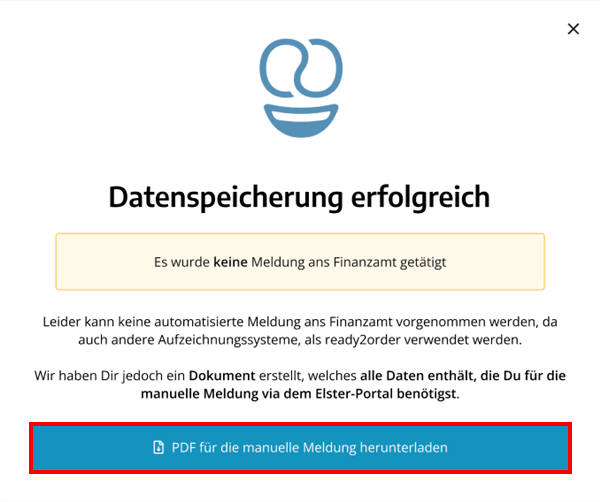

The data was saved successfully, but no report/submission was made to the tax office. You must now submit this data manually through the ELSTER portal. During the data entry process, a document was created that contains all the necessary data that you will need in the ELSTER portal. You need to download this file.

Now use the data from the PDF to carry out the submission in the ELSTER portal. A detailed description for this can be found in the instruction guide for reporting electronic recording systems (German) provided by the Federal Ministry of Finance:

FAQ-Instruction-guide.pdf (German)

3. Enter the data from the DSFinV-K export

You can also follow the steps in the instruction guide for reporting electronic recording systems (German) and directly search for the data in the various files of your DSFinV-K export. You can find this export under Preferences > Fiscalization & TSE > Exports in your Admin Interface.

Manual reporting of data changes using multiple recording systems

If your company data changes, you should first have us change your company data. Please contact service@ready2order.com. As soon as the data change has been made in our system, you must make it in your ELSTER portal.

How do I deregister manually?

If your subscriptions with ready2order have expired because you canceled them, you must manually deregister through the ELSTER portal no later than one month after the cash register is taken out of service. You must always do this manual deregistration, regardless of whether you registered automatically via ready2order or you did it manually.

To do this, first go to Settings > Fiscalization & TSE > Exports in your Admin Interface. Download the PDF document and enter the license expiration date of the cash register subscription in the decommissioning date field.

Now use the data from the PDF to deregister in the ELSTER portal. A detailed description for this can be found in the instruction guide for reporting electronic recording systems (German) provided by the Federal Ministry of Finance:

FAQ-Instruction-guide.pdf (German)