FinanzOnline Change company data

UID number or tax number changes, what should I do?

The access data for FinanzamtOnline must be corrected in the correct order. In this case, the process must be carried out in reverse, so follow our instructions step by step , otherwise it will no longer be possible to deregister the cash register.

If you only have one tax number (e.g. as a small business owner), you must completely deregister your cash register and register it again in order to change it.

If you have a UID number that remains the same but your tax number changes, you can change it under point 1.

Please note that when you register through ready2order, the data you entered in our system will be used. We ask that you always keep your data up to date.

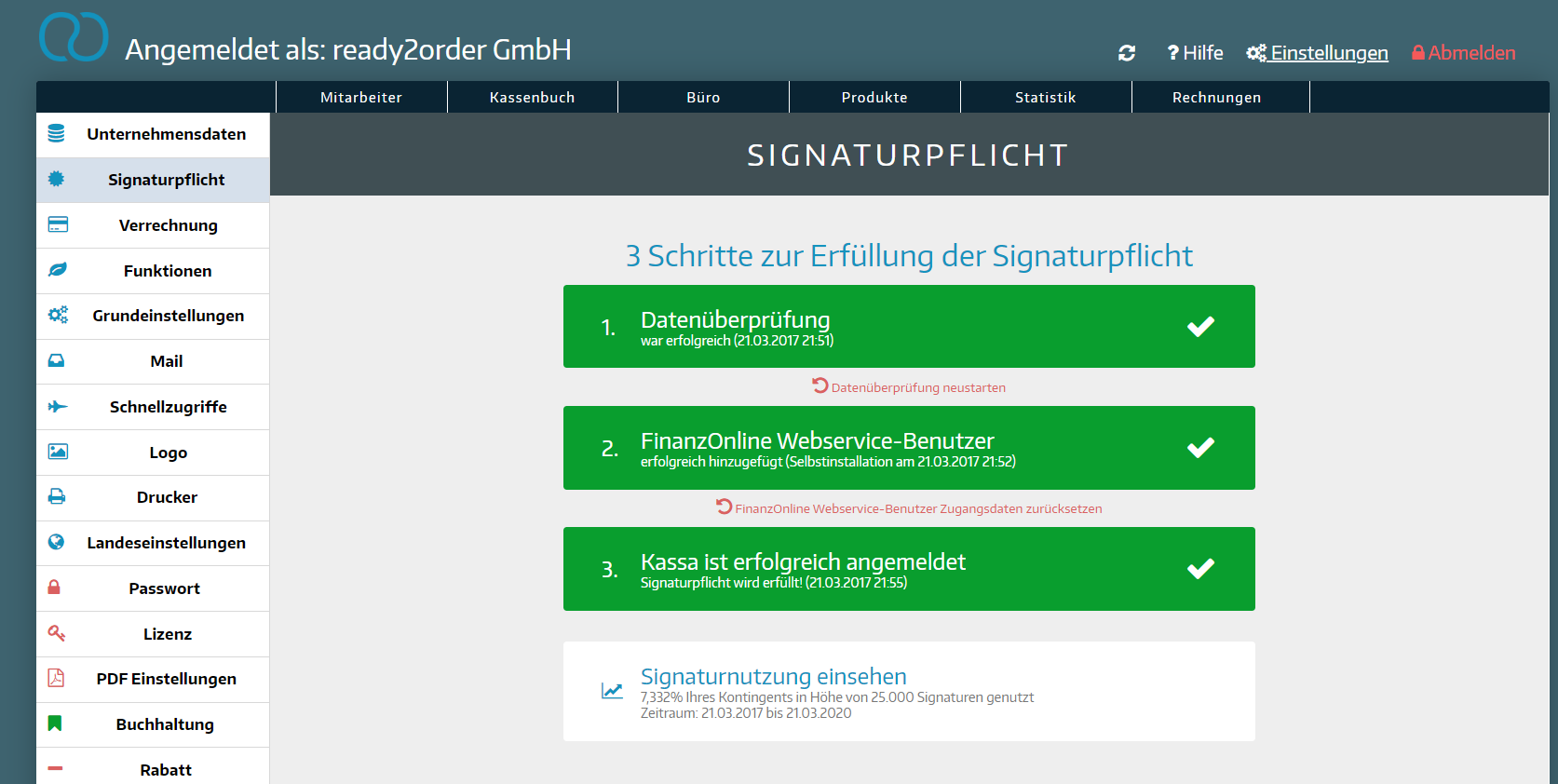

Here's what you should do if your data changes:

- First you have to reset the third step and deregister the cash register

- Click on point 3 "Kassa is successfully registered"

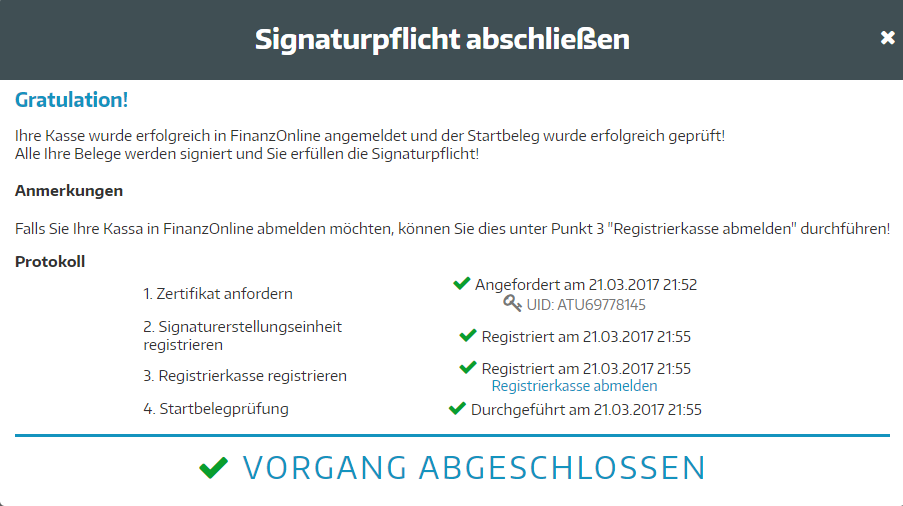

- A pop-up appears: "Complete signature requirement"

- In point 3, click on "Deregister cash register"

- A second pop-up appears: "Reset certificate/certificate canceled"

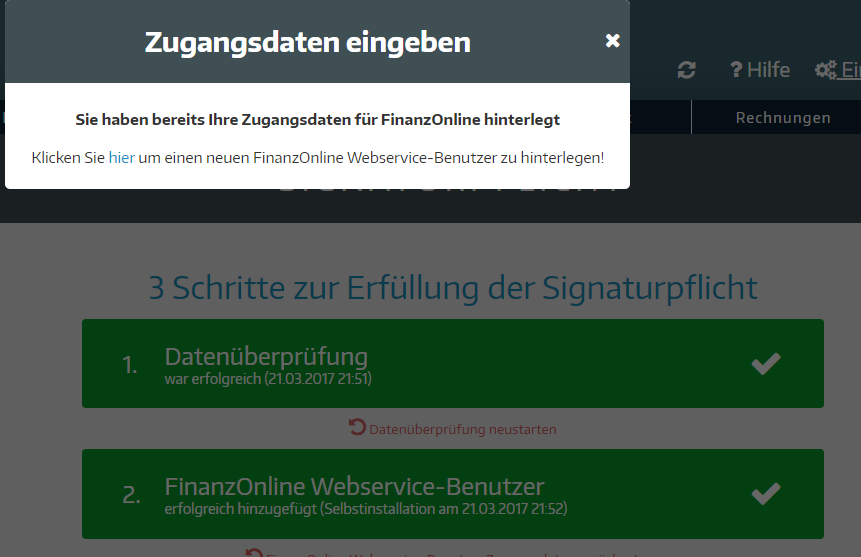

- If your certificate is cancelled, you must reset the second step: FinanzOnline Webservice-user

- You will now see the pop-up "Enter login details"

- Click “here” to reset the second step

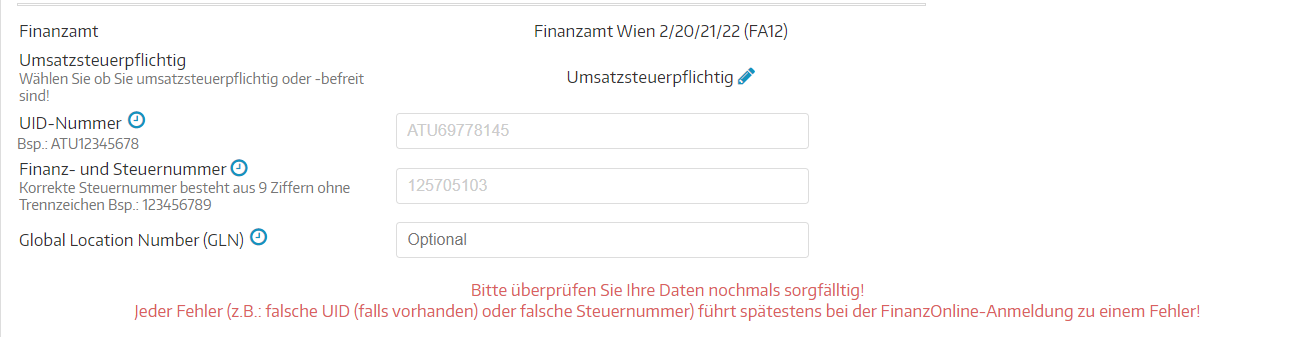

- Now complete the first step to change your data

- You will now see the “Check data” pop-up

- Confirm "Change data"

- You will be redirected and can enter the new data here:

- You will now see the “Check data” pop-up

- Now in step two, create your new web service user on FinanzOnline

You can find out how this works in this article!- Click on "here" in the pop-up and enter your new web service user

- Now click on the 3rd step "Complete signature requirement" – now your cash register is fully registered!

If logging out of the checkout does NOT work, please send us an e-mail to ready2order. We will be happy to help you!