Cost centers

In this article we will show you how to create, save and delete cost centers. Saving is possible for product groups, products and tax rates for products with multiple tax rates. Before you can create cost centers, you must activate the cost centers function. You can see how this works in the following point.

Activate function

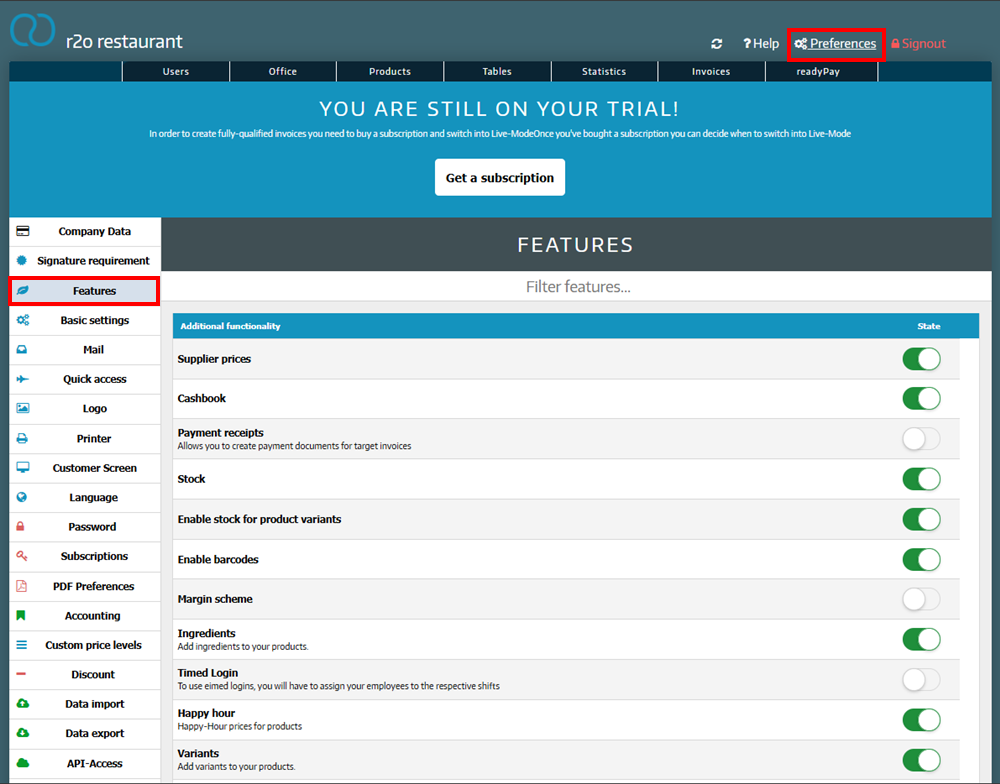

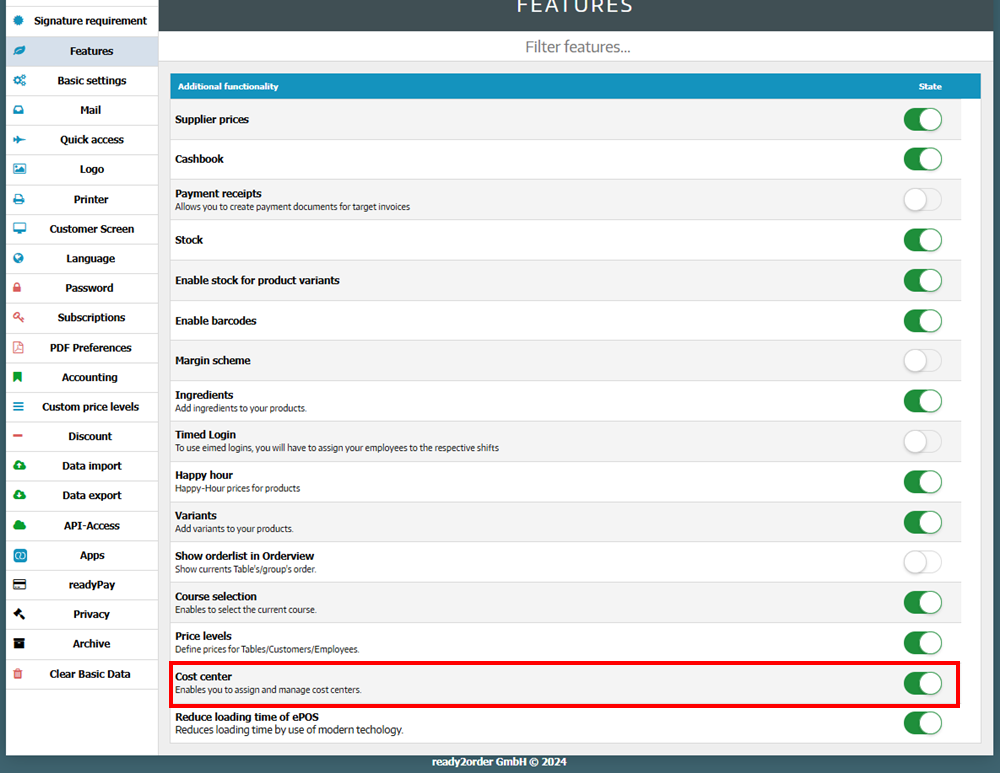

To activate the cost centers function, first go to your Admin Interface and then proceed as follows:

- Select Preferences

- Then go to Features

- Scroll until you see the Cost Centers function and click the slider to activate the function

Create cost centers

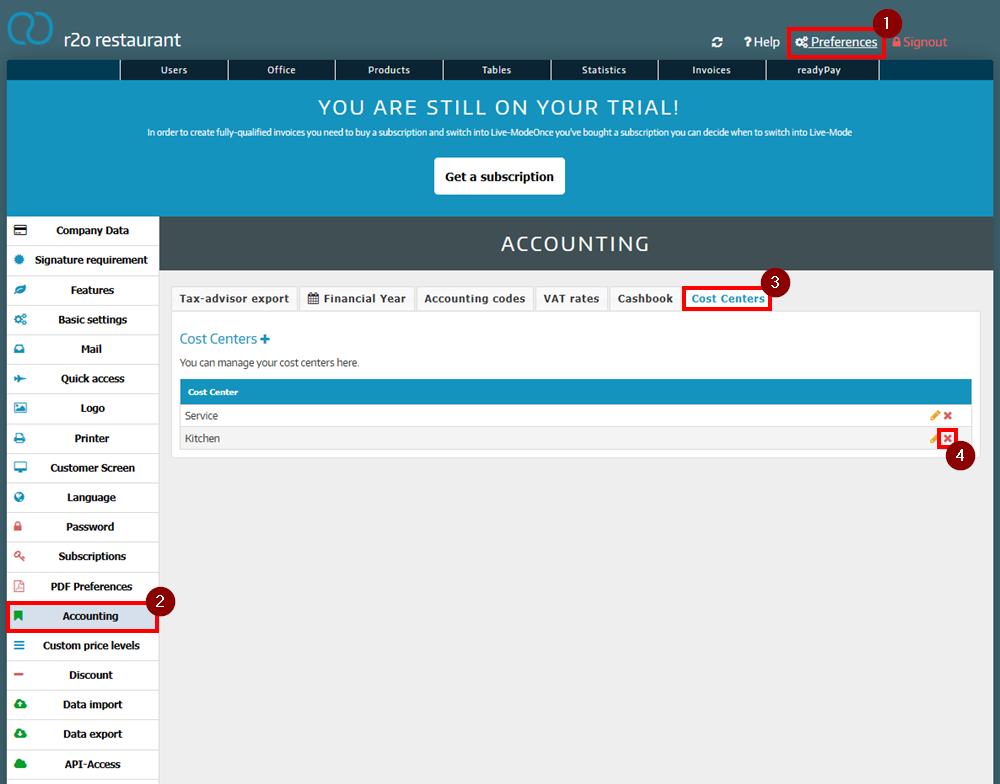

To create a cost center, follow these steps:

- Go to your Admin Interface

- Select Preferences

- Go to Accounting

- Click on the Cost Centers tab

- Click on the blue + next to the word Cost centers

- Enter the desired name and click Save

Define cost centers

You can define cost centers for product groups, products, and tax rates for products with multiple tax rates.

Store cost centers in product groups

- Go to your Admin Interface

- On the Products tab, select product groups

- Click on the product group for which you want to store the cost center

- Select the Reports tab there

- Under Cost Center, select your desired cost center

- Click Save

Assign cost centers to products

- Go to your Admin Interface

- Click on the Products tab

- For the desired product, click on the yellow pencil on the right side

- In the General tab, select your desired cost center under Cost Center

- Then click Save Changes

Define cost centers for tax rates of products with multiple tax rates

- Go to your Admin Interface

- Click on the Products tab

- For the desired product, click on the yellow pencil on the right side

- In the General tab, under Number of tax rates, select the desired cost center for the respective stored tax rates under Cost center

- Then click Save Changes

Which cost center is selected if a cost center is stored for both the product group and the product?

If a cost center is stored for both the product group and the product, the cost center that was stored directly for the product is used.

What happens if the cost centers are deactivated in the features?

If you deactivate the cost centers function in your Admin Interface under Preferences > Functions, cost centers will no longer be taken into account from that moment on. The cost centers that were recorded before deactivation will remain saved, but will not be visible in the exports. If you reactivate the function, the cost centers will be taken into account again from that point on and displayed in the exports.

Delete cost centers

You can only delete a cost center if it is no longer stored for any product.

- In your Admin Interface go to Preferences

- Select Accounting

- Go to the Cost Centers tab

- Click on the red x for the cost center you want to delete

- In the window that appears, select Yes, delete! if you really want to delete the respective cost center

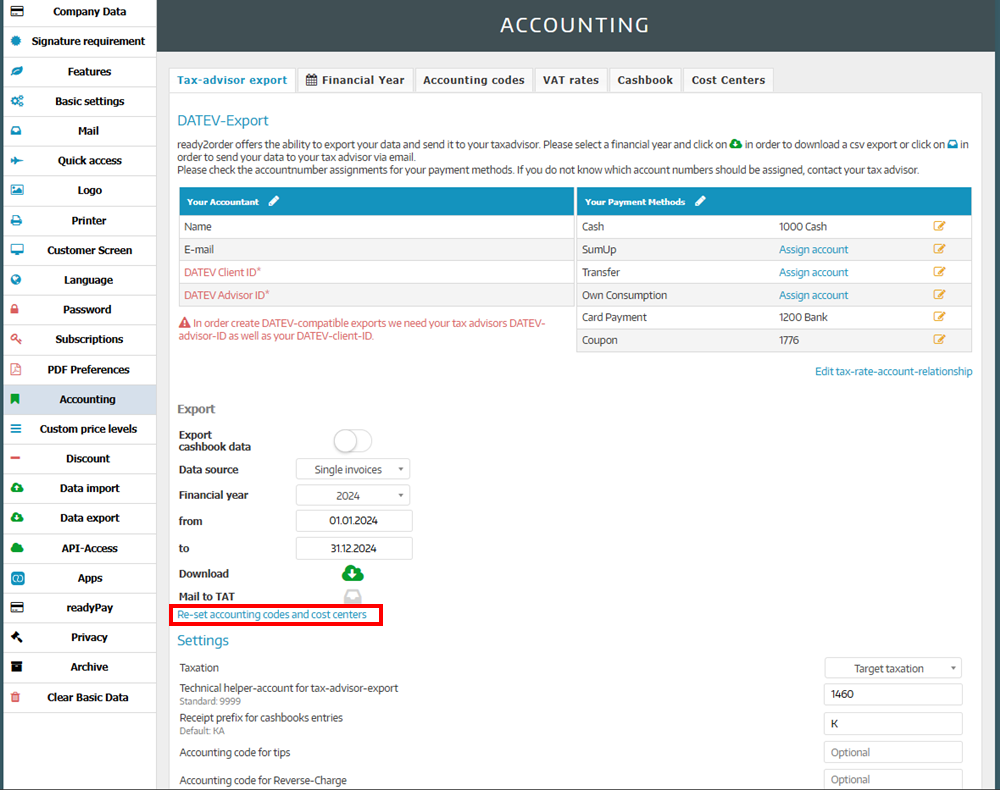

Reset cost centers for past entries

If you change a stored cost center, you can use Accounting code n and Reset cost centers command to store the newly stored cost center for past entries. You can do this as follows:

- Go to your Admin Interface

- Click on Preferences

- Select Accounting

- In the tax advisor export tab, click on reset accounting codes and cost centers