How does the automatic annual document check work?

Understanding the annual audit

Here you can activate the automatic annual document check!

(Only for customers from Austria)

Since 2017, the annual receipts of all companies in Austria have to be checked due to the Cash Register Security Ordinance. As an entrepreneur, you must therefore create your annual receipt at the end of the calendar year, submit it to the tax office, and then keep it safe.

If you don't manage to do this by the end of the year, you have until February 15 (exactly 45 days after the end of the calendar year) to do it.

Furthermore, it is important to mention that the last monthly receipt of the calendar year is referred to as the annual receipt (normally the monthly receipt from December; for seasonal businesses it can also be an earlier monthly receipt).

Like every monthly document, the annual document is also a zero-date document (annual document) . The calendar year also applies to the creation of the annual document. An adjustment to a different financial year is not foreseen.

Here we show you how to download the zero receipt (annual receipt)!

How is the test carried out?

The check can be done manually or with the automatic annual document check from ready2order.

If you do the annual receipt check manually, you need an external app from the Federal Ministry of Finance. This must be used to scan and enter the annual receipts, which takes time and resources. In addition, you as the entrepreneur must coordinate your annual receipt check - you must ensure that the tax office receives all the files and stay on top of things once the check has been done. If an error occurs or if a scan was not successful, you may have to repeat this process. If you do the annual receipt check manually, the printed receipt must also be kept for 7 years.

That’s why we have an alternative:

The automatic annual document check by ready2order

If you want ready2order to carry out the annual receipt check automatically, you don't have to worry about anything. The annual receipt is created automatically and sent to the tax office during the first calendar month. As soon as the check is complete, you will be informed by email.

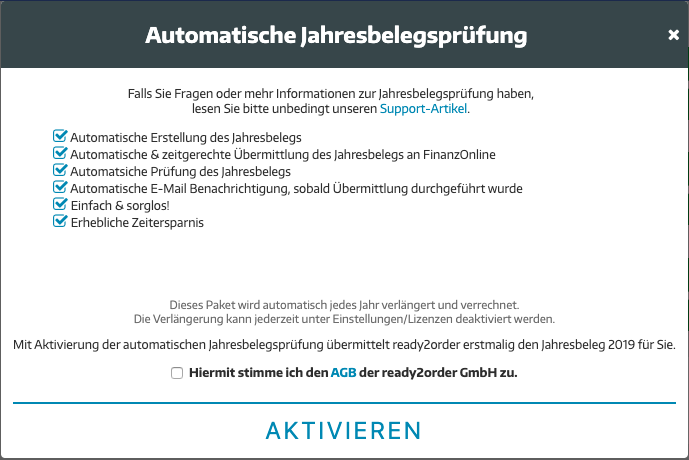

Therefore we recommend the automatic check:

- Automatic creation of the annual document

- Automatic & timely transmission of the annual receipt to FinanzOnline

- Automatic verification of the annual document

- Automatic email notification as soon as the transmission has been completed

- Simple and carefree

- Significant time savings

- The annual receipt does not have to be printed with an A4 printer as it is created electronically

- The retention period of 7 years is not applicable for automatic verification

Where can you find the automatic checking function?

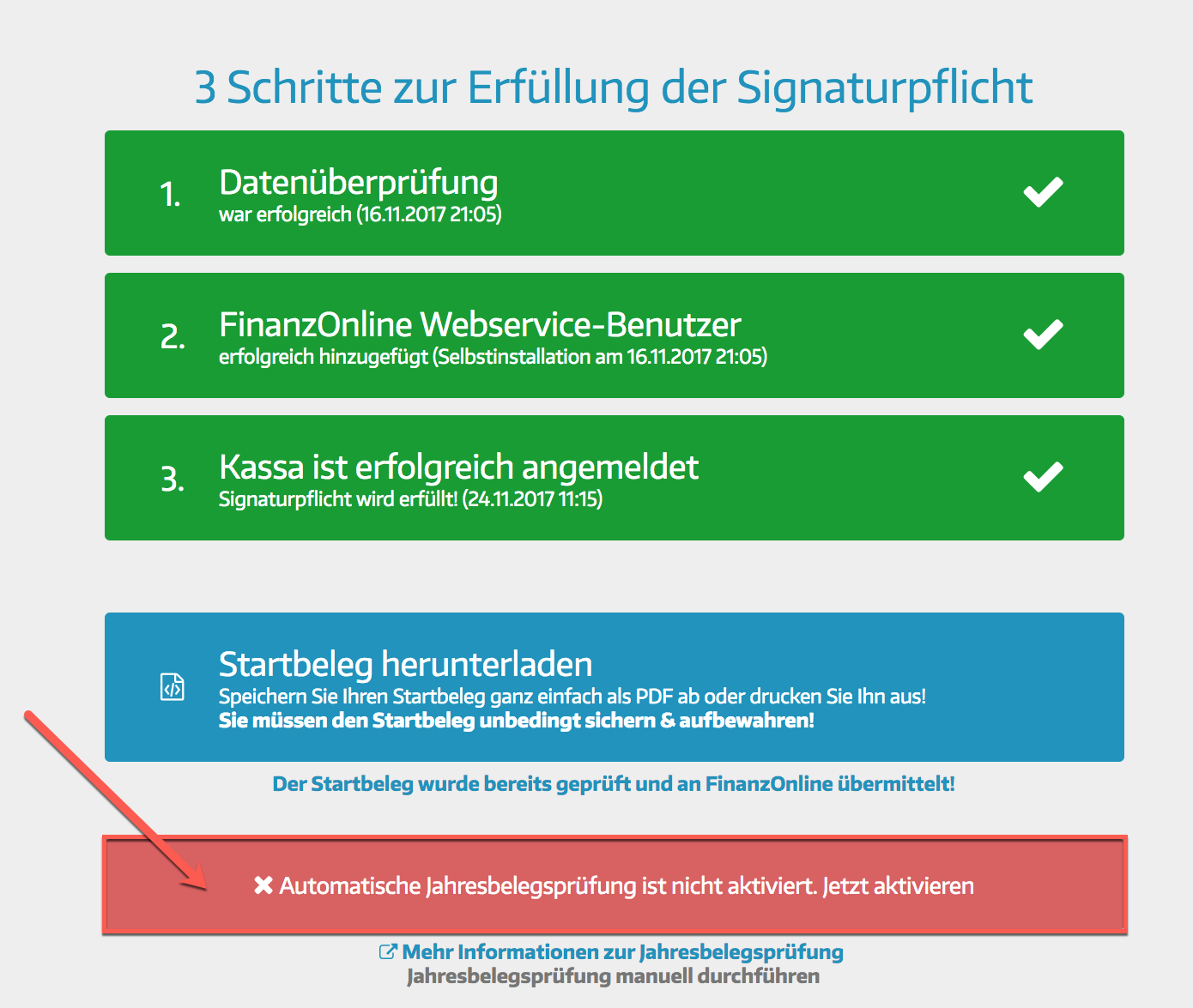

Log in to your Admin Interface and proceed as follows:

- Click on settings in the top right

- In the left tab, click on Signature requirement

- Click on " Automatic annual document check is not activated. Activate now"

- This pop-up menu appears. Check the box " I hereby agree to the terms and conditions of ready2order GmbH." Then click on " Activate"

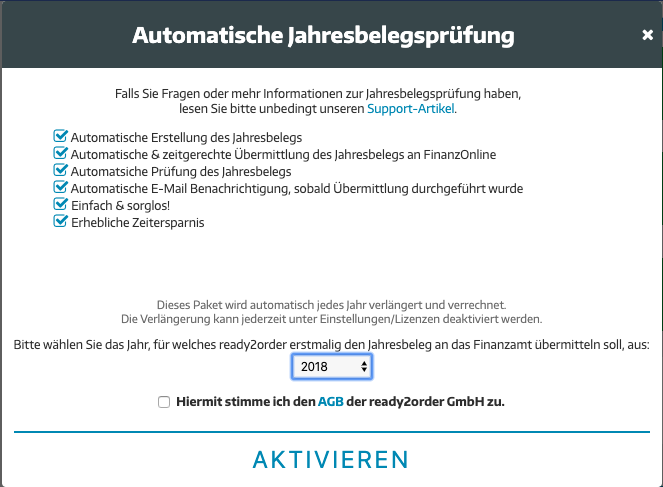

If you have several years available, select the year for which the automatic annual document check should be carried out from the drop-down menu.

Check the box " I hereby agree to the terms and conditions of ready2order GmbH." Then click on "Activate"

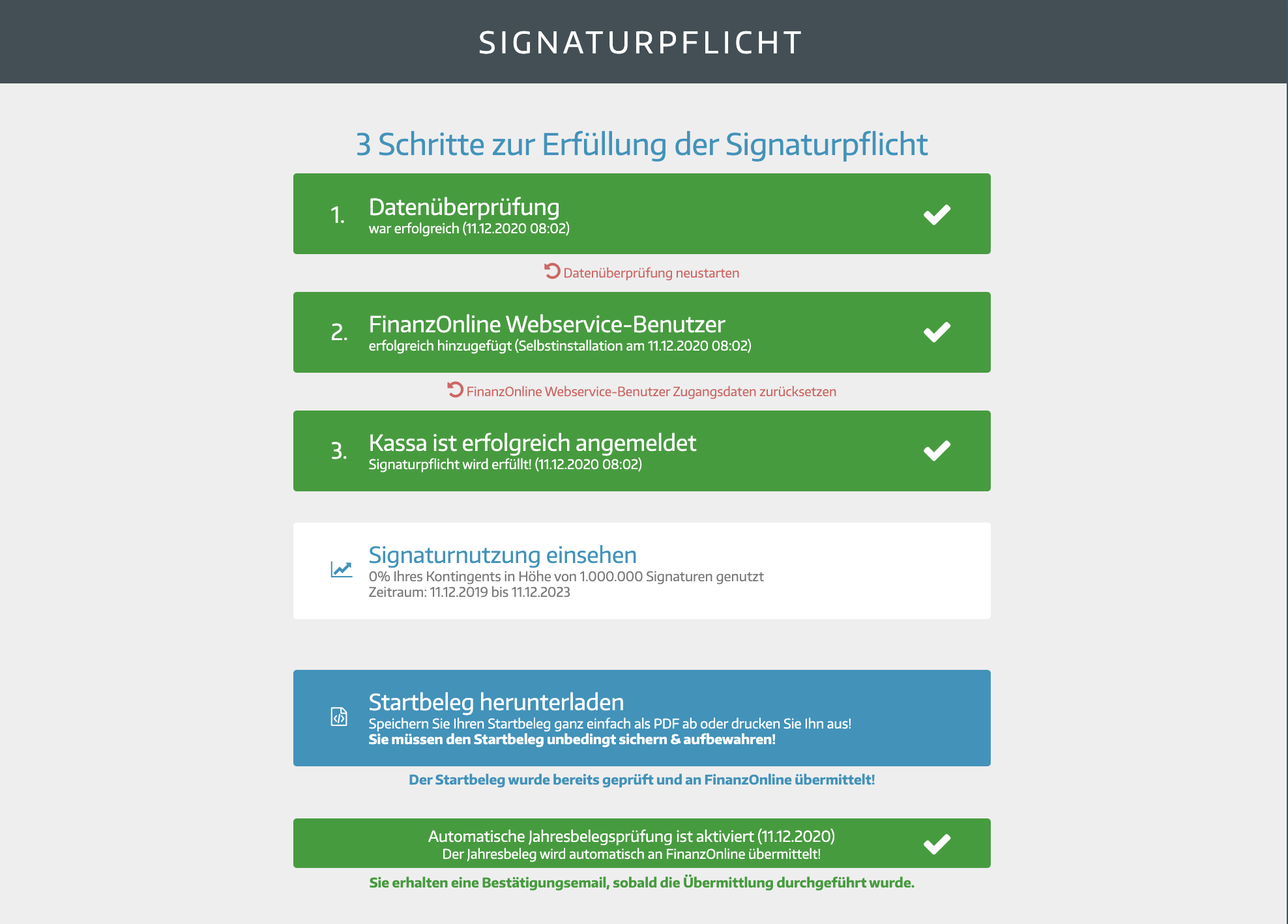

You will now see a confirmation of the automatic annual document check