Add a VAT rate or change the VAT rate for products

Would you like to change the VAT rate for one or more products? No problem, you can easily create or change it in the Admin Interface.

You can delete and add new VAT rates and assign them to your products in the administration interface.

Please note that after successfully changing the VAT rates, you must reload the POS (to rule out errors in the data transfer to the POS)

The VAT rate of some products has changed, how do I update the VAT rate in the system?

To update the VAT rate, you must first log in to the Admin Interface.

- Click on Products

- Select the respective product by clicking on the yellow pencil (edit) to the right of the product

- Under VAT, click on the drop-down menu and select the desired tax rate

- Click Save

- Follow these steps for all products where you want to change the VAT rates

Please note that after successfully changing the VAT rates, you may reload the POS (to rule out errors in the data transfer to the POS).

To change the VAT rate of several products at the same time, proceed as follows:

- Check the box on the left next to the products whose VAT rate you want to change

- Check the box in the top left row to select all products on this page at once

- Click on the drop-down menu in the top right corner labeled "Action "

- Scroll down in the dropdown to the created VAT rates

- Select the desired VAT rate

- Confirm the pop-up "Do you really want to change VAT rates to ..%?" with OK

- The VAT rate is now stored for all selected products

Please note that after successfully changing the VAT rates, you may reload the POS (to rule out errors in the data transfer to the POS).

You can also add new VAT rates. To do so, follow these steps:

- Click on settings

- Select Accounting from the menu on the left

- Now click on the VAT Rates tab

- Click on the green + to add a new VAT rate

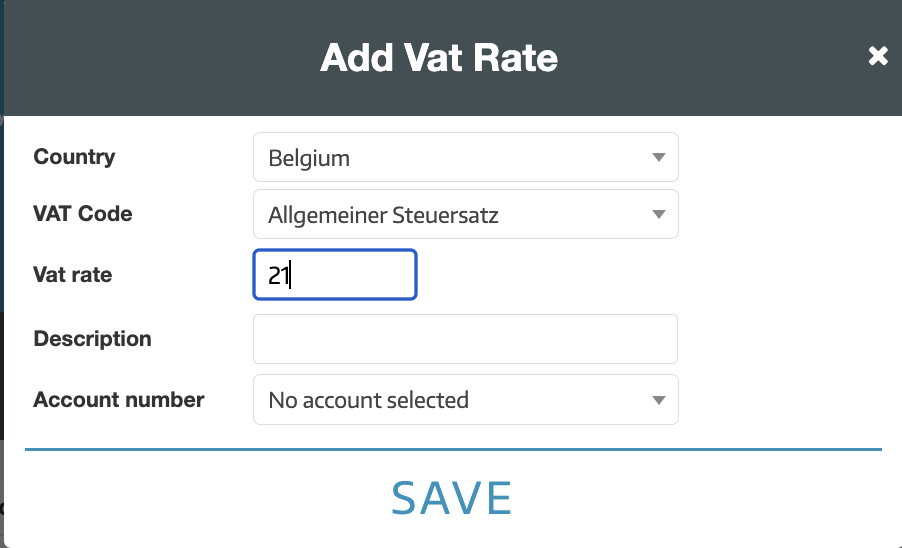

- Enter the desired tax rate as a number without the percent symbol

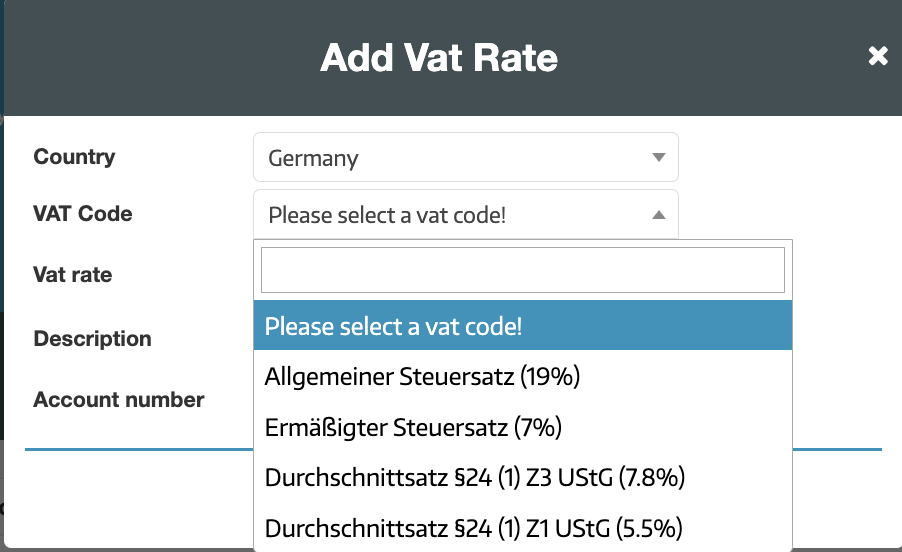

- Select the country for which this VAT rate applies

- Select which kind of VAT rate you want to create through the VAT code (General-, Reduced-, Special-VAT-rate)

- For Germany, Austria, and Switzerland the VAT codes also define the VAT rate

- If you are creating the VAT rate for another country then you have to enter the desired VAT rate as a number (without the percent symbol)

- For Germany, Austria, and Switzerland the VAT codes also define the VAT rate

- Optionally enter a description and an account number for your bookkeeping

- Click Save