How can I charge deposits on my products?

With ready2order, you can easily create a deposit in the management interface.

To do this, you need to set up two products:

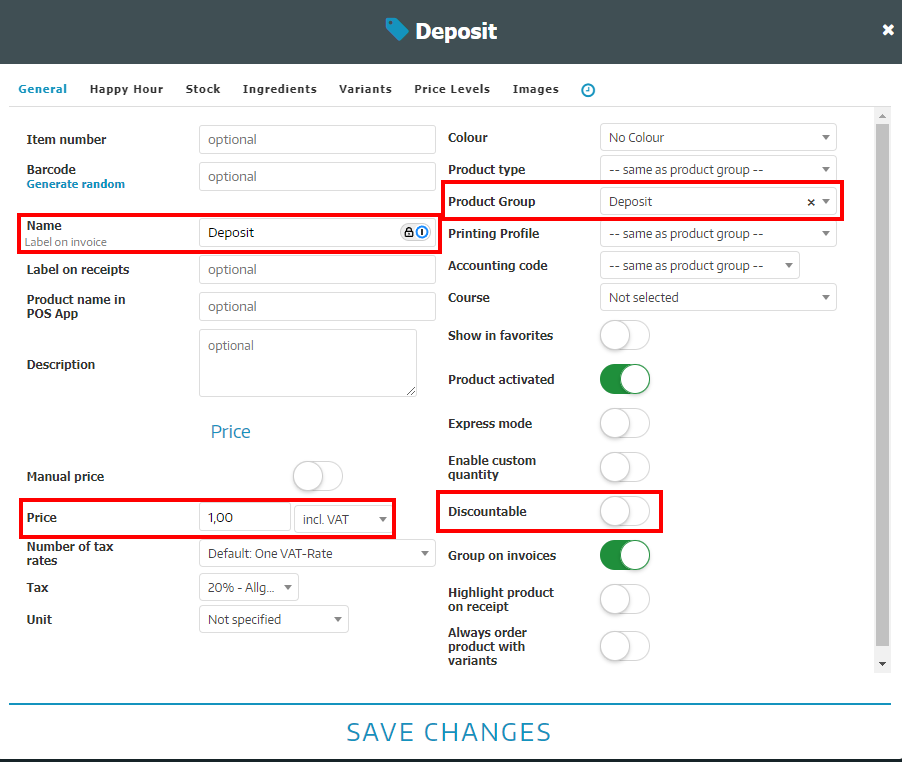

- A new product named Deposit

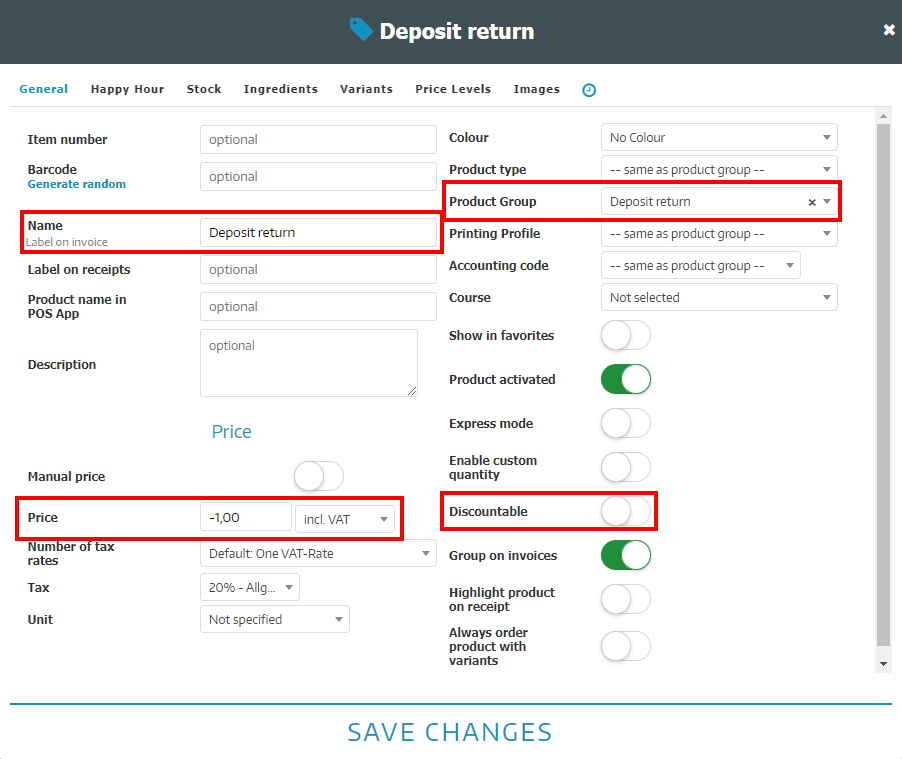

- A new product named Deposit Return

Create a deposit

To create a new product, proceed as follows:

- Open the Admin Interface

- Click on Products

- Click on the product group for which the deposit is to be created

- Click on the blue + next to Products

- Enter the name Deposit or Deposit Return

- Enter the following as price

- For Deposit: enter a positive amount, e.g., 0.25.

- For Deposit Return: enter a negative amount, e.g., -0.25.

- Choose product type deposit or deposit refund

- Both are not eligible for discounts

- Click Save

Linking a Deposit to an Existing Product

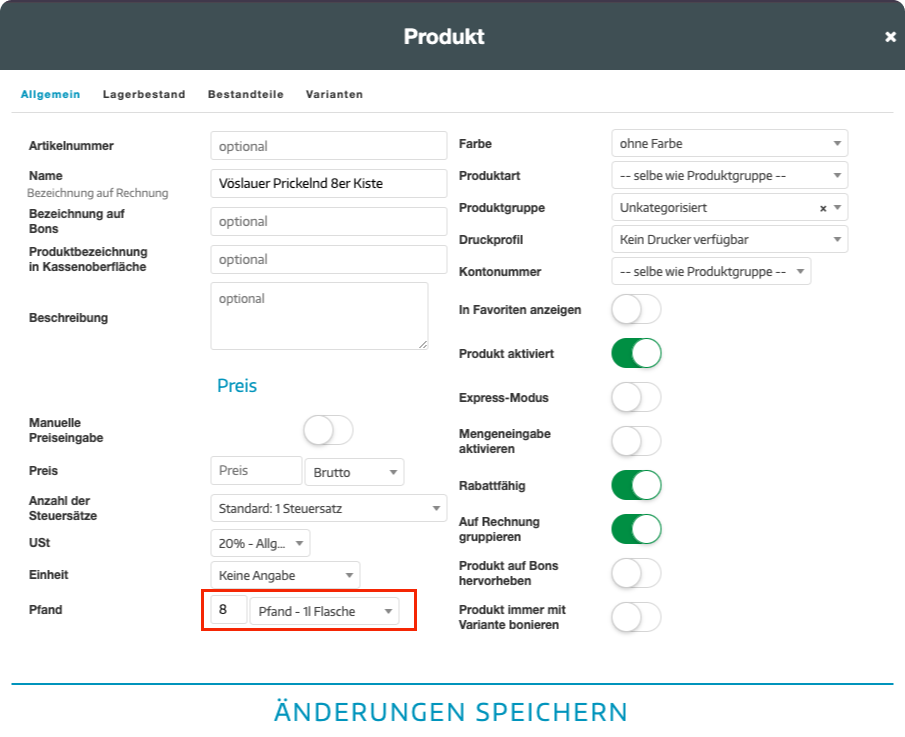

To link a deposit product to an existing item, follow these steps:

- Click on the pencil icon next to the desired product to edit its details.

- Enter the quantity of the deposit and select the previously created deposit product from the list.

- Click Save Changes.

- The table will now display the deposit details.

Linking multiple products to a deposit at once

Here’s how to link a deposit product to several existing items:

- Select the desired products by checking the boxes next to them.

- Open the “Actions” dropdown menu in the top right.

- Scroll down and choose “Update Deposit.”

- A new window will open—select the desired deposit and specify the quantity.

- Click “Save,” and all the selected products will be linked to the deposit.

Applying a Deposit in the POS Interface

When you select a product in the POS that is linked to a deposit, the deposit will automatically be added to the shopping cart.

The following illustration also demonstrates how to correctly input a deposit return.

Displaying Deposits on Invoices – A Complex Topic

How deposits are displayed on invoices varies depending on the country and deposit system. Different rules apply for single-use and multi-use deposits, each with specific tax implications.

To avoid legal and tax issues, it is advisable to consult a tax advisor if in doubt.

Single-Use Deposit – Austria 🇦🇹

In Austria, deposits on single-use beverage packaging are generally not taxable under the Deposit Ordinance.

Commercial distributors collect the deposit on behalf of and for the account of the central entity. These deposit amounts are not subject to VAT as they are considered a refundable security deposit.

These deposit amounts must be shown separately from the goods value on the invoice and without VAT.

A note stating that the amounts are collected and refunded on behalf of the central entity is generally not required.

Single-Use Deposit – Germany 🇩🇪

In Germany, deposits are subject to VAT, and the VAT rate depends on the type of goods associated with the deposit.

For example, a deposit for soft drinks may be taxed at 19%, while for certain dairy products, it may be taxed at 7%.

The deposit is considered part of the tax base for VAT, meaning VAT is also charged when the deposit is collected.

Upon refunding the deposit, the VAT must be adjusted accordingly.

Multi-Use Deposit – Germany 🇩🇪 and Austria 🇦🇹

In both countries, multi-use deposits are generally considered part of the payment for the enclosed goods and are therefore subject to VAT.

In practice, the deposit affects the tax base for VAT and must be listed on the invoice with VAT.

Since the rules and their application can vary depending on circumstances, it is strongly recommended to consult a tax advisor if there are uncertainties to ensure all tax requirements are met correctly.