The entire invoice creation process in the cash register briefly explained

Creating invoices offers you many options that make your daily routine much easier. Here you will find a general, short explanation of the invoices in the cash register and the various features that you have here!

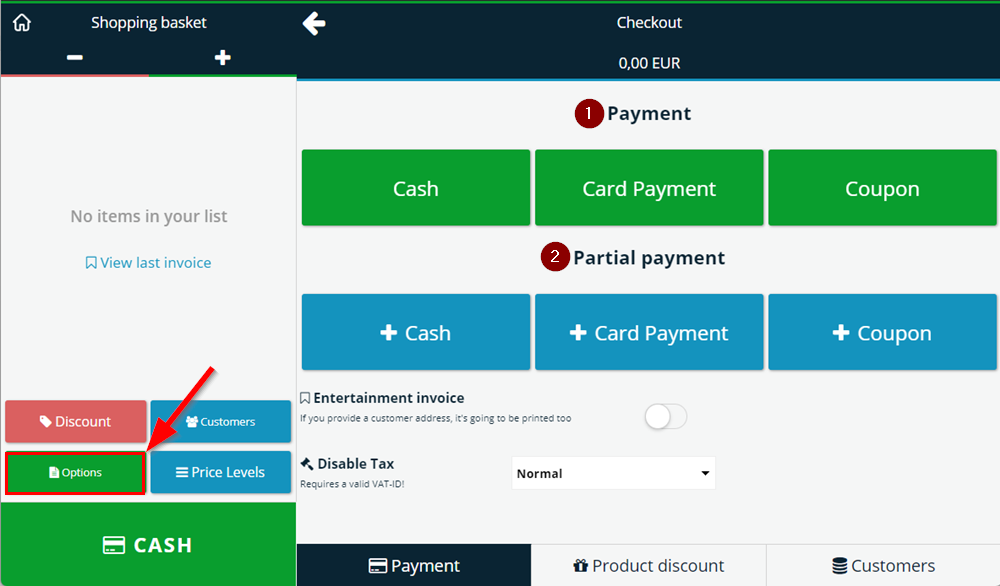

Choose payment method

When you are paying, you can choose between the different options that you have stored as a payment method. To do this, simply click on Options on the left.

In our example there are the following payment options:

- Cash

- Card Payment

- Coupon

Now there are two possibilities:

- If the customer wants to pay the entire amount, use the green button under "Payment"

- However, if the customer wants to make a partial payment, you must use the blue button under "Partial payment"

Assign invoice to a customer

To assign the invoice to a specific customer, proceed as follows:

- Click the blue button called "customer"

- Select the customer to whom you want to assign the invoice – in our example this is "Müller Heiko"

- Instead of the blue customer button, the button on the left now has the name "Heiko"

- Click on "Cash payment" to confirm the transaction

Create new customers

To create a new customer, proceed as follows:

- Click the blue customer button in the billing field

- Click on the green button called "add new customer"

- A new window will open where you can enter all customers data

- Under "additional information" you can add notes or enter the customers's VAT number

- Click Save to save the customer

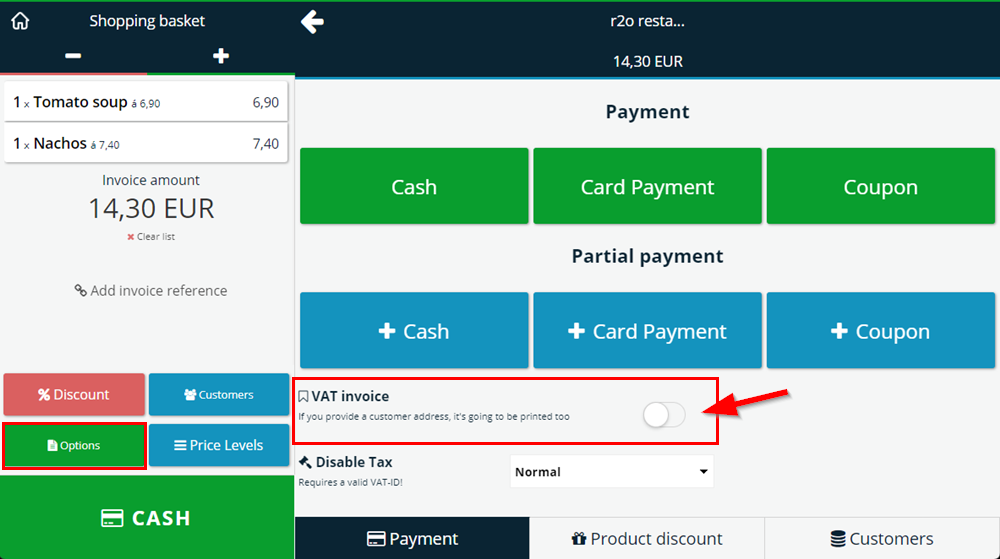

Show VAT on the invoice

VAT is always printed on the invoice if a tax rate has been set for the product. This setting represents the VAT invoice.

- Select products for the invoice

- Click the green options button

- If the VAT invoice/invoice header button is activated (=green color), a VAT invoice is created

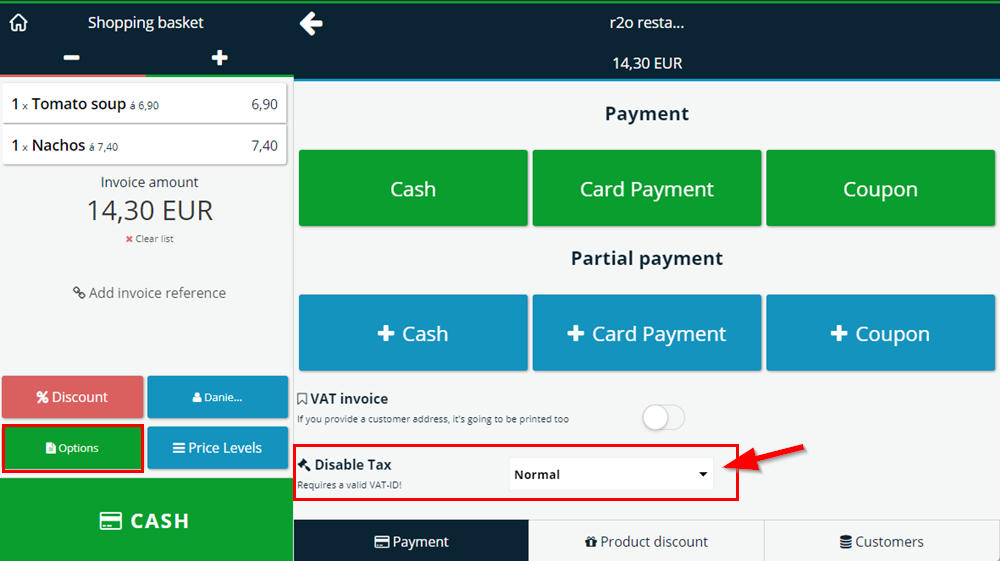

VAT exemption

To exempt a customer from VAT, proceed as follows:

- Select products

- Assign the invoice to a customer

- Click the green options button

- You will find the options for VAT exemption at the bottom right

Add invoice reference

To add an invoice reference, proceed as follows:

- Select products

- Click on "Add invoice reference"

- Enter the reference number

- Choose between not charging sales tax or charging normal sales tax

- Choose between fee note, invoice and other reference

- On the left side you will now see the reference number

- Click "Cash payment" and the invoice will be saved

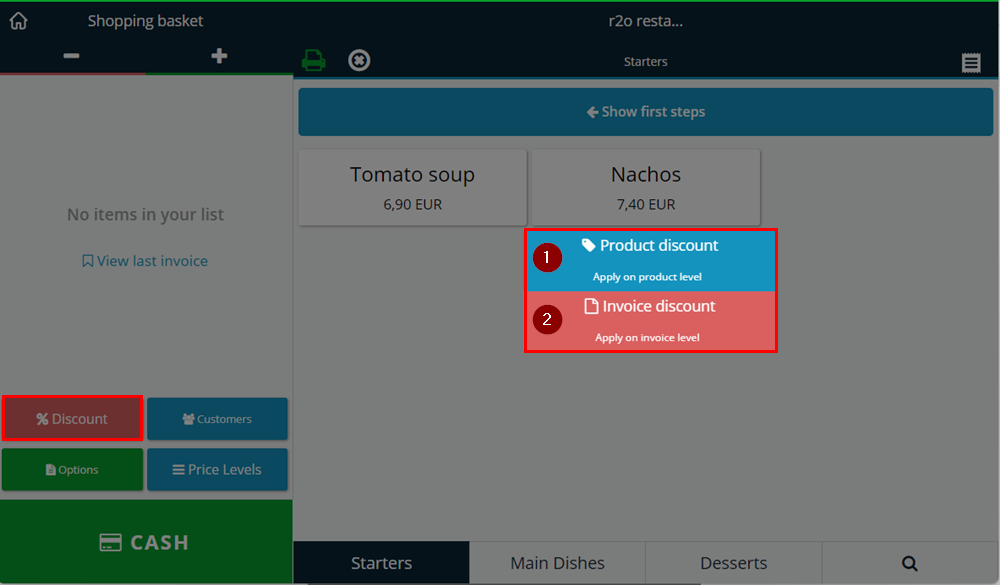

Product and invoice discounts

There are two ways in which you can charge discounts to your customers:

- a discount on a specific product

- a discount on the entire invoice

Now proceed as follows:

Select products for the invoice.

Click on the red % Discount button on the left.

Choose between product discount and invoice discount.

1. Product Discount

With a product discount, individual products are discounted. There are various options to choose from:

- A total discount: If several products have been selected, you can give a total discount of a fixed amount or a percentage on the products.

- A discount per unit: If you have several items of a product on the invoice, a discount is given on each of these products individually.

- A discount for just one item: If you have several items of a product on the invoice, a discount will only be deducted from one product.

For all three categories you can either select

- an amount - e.g. the product is discounted by 3 euros -,

- a percentage - e.g. the product is discounted by 10% - or

- a target price - the product should now cost 3 euros

2. invoice discount

With the invoice discount, a discount is deducted from the entire invoice.